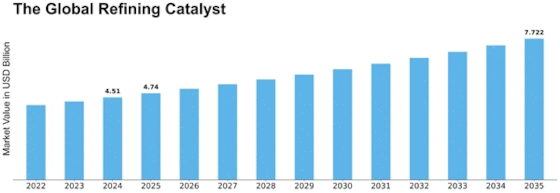

Refining Catalysts Size

Refining Catalysts Market Growth Projections and Opportunities

The refining catalyst market is influenced by various market factors that shape its dynamics and growth trajectory. One significant factor is the demand for refined petroleum products worldwide. As economies grow and industrialization expands, there's a continuous need for gasoline, diesel, jet fuel, and other refined products. This demand directly affects the refining industry, which in turn drives the demand for refining catalysts. Additionally, government regulations and environmental policies play a crucial role. Stringent regulations aimed at reducing emissions and improving fuel quality necessitate the use of advanced catalysts in refining processes to meet these standards.

catalyst enhances the rate of chemical reactions and are considered a critical part of a process in terms of cost and time efficiency. Refinery catalyst are used in refineries for the process of converting petroleum refining products from crude to high octanes liquid products such as diesel, kerosene, gasoline, and others. These catalysts are used in various processes such as hydrotreating, hydrocracking, and catalyst reforming among others.

Technological advancements also impact the refining catalyst market. Innovations in catalyst formulations and manufacturing processes lead to the development of more efficient and selective catalysts. These advancements help refiners improve yields, enhance product quality, and optimize their operations, thereby driving the adoption of new catalyst technologies. Moreover, the shift towards renewable and alternative energy sources influences the market. As the world transitions towards cleaner energy sources, refiners are compelled to adapt their processes and products accordingly, driving the need for catalysts tailored for renewable fuel production and refining biofuels.

Supply chain dynamics are another critical market factor. The availability and cost of raw materials used in catalyst production, such as zeolites, metals, and chemicals, impact the overall cost structure and profitability of catalyst manufacturers. Fluctuations in raw material prices or supply disruptions can affect the pricing and availability of refining catalysts, influencing market dynamics. Additionally, geopolitical factors and trade policies can impact the global supply chain, leading to uncertainties in the refining catalyst market.

Market competition also shapes the dynamics of the refining catalyst market. The presence of multiple players, ranging from large multinational corporations to small regional suppliers, fosters competition based on product quality, price, and technological capabilities. Innovation and product differentiation become key strategies for companies to gain a competitive edge and capture market share. Market consolidation through mergers and acquisitions is another trend observed in the refining catalyst industry, as companies seek to expand their product portfolios and geographical presence to strengthen their market position.

Furthermore, economic factors such as GDP growth, industrial output, and investment in infrastructure influence the demand for refined products and, consequently, the demand for refining catalysts. Economic downturns or fluctuations in oil prices can impact refining margins and capital expenditure in the refining sector, affecting the investment decisions related to catalyst procurement and adoption of new technologies. Additionally, regional market dynamics, such as refinery capacity expansions or closures, regulatory changes, and shifting demand patterns, vary across different geographical regions and impact the local refining catalyst markets differently.

Environmental concerns and sustainability goals are increasingly driving the demand for eco-friendly catalysts. Refiners are under pressure to reduce their environmental footprint and minimize waste generation. As a result, there's a growing demand for catalysts that enable cleaner and more sustainable refining processes, such as catalysts with higher activity and selectivity, as well as catalysts tailored for renewable feedstocks and biofuel production. Companies that can offer innovative solutions to address these environmental challenges stand to gain a competitive advantage in the market.

Leave a Comment