Market Share

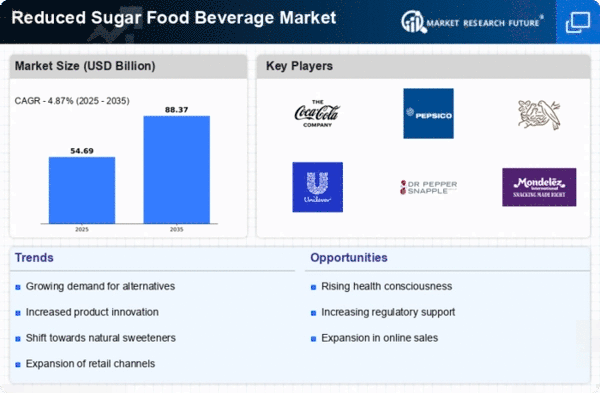

Reduced Sugar food beverage Market Share Analysis

The Reduced Sugar Food and Beverage Market is experiencing a paradigm shift in response to heightened consumer awareness of health and wellness. In this competitive landscape, companies are implementing a variety of market share positioning strategies to cater to the growing demand for reduced sugar products. One pivotal strategy is differentiation, where companies focus on creating innovative and flavorful reduced sugar options that closely mimic the taste and texture of their full-sugar counterparts. This involves leveraging alternative sweeteners, natural flavors, and advanced formulation techniques to provide consumers with healthier alternatives without compromising on sensory experiences.

Cost leadership is a significant approach within the Reduced Sugar Food and Beverage Market. Some companies aim to become efficient producers of reduced sugar products, enabling them to offer competitive prices to consumers. This strategy involves optimizing production processes, sourcing alternative sweeteners and ingredients cost-effectively, and achieving economies of scale. By providing affordable yet high-quality reduced sugar options, companies adopting cost leadership strategies can appeal to a broader consumer base, including price-sensitive shoppers looking for healthier alternatives.

Niche targeting plays a vital role in market share positioning for reduced sugar products. Instead of catering to the entire food and beverage market, some companies concentrate their efforts on specific niches or product categories. For example, a brand might specialize in producing reduced sugar snacks, targeting health-conscious consumers seeking guilt-free indulgence. By tailoring offerings to niche markets, companies can build brand loyalty within specific consumer segments and establish a strong foothold in those areas of the market.

Collaboration and partnerships are increasingly common in the Reduced Sugar Food and Beverage Market as companies seek to enhance their offerings and market reach. Collaborative efforts with ingredient suppliers, research institutions, or retail partners can lead to innovative product development, joint marketing initiatives, and expanded distribution channels. These collaborations enable companies to tap into new markets, leverage shared expertise, and strengthen their market position by offering a diverse range of reduced sugar options.

Customer-centric approaches are fundamental in the reduced sugar sector, where understanding and meeting consumer expectations is critical. Successful companies invest in market research to stay abreast of evolving consumer preferences, health trends, and dietary concerns. Whether developing clean-label options, addressing specific dietary needs, or ensuring that reduced sugar products align with varying taste preferences, customer-centric strategies are essential for maintaining a competitive edge in a market driven by health-conscious consumers.

Leave a Comment