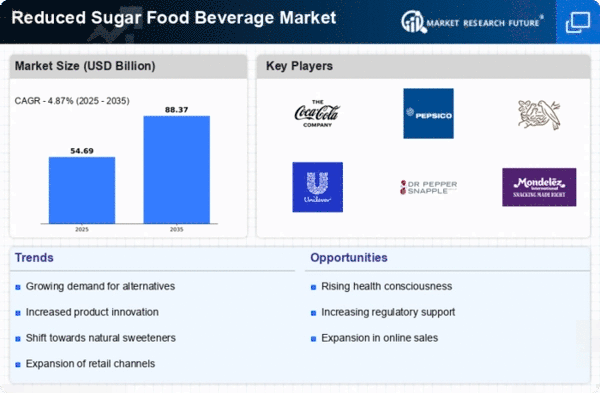

Top Industry Leaders in the Reduced Sugar food beverage Market

The Competitive Landscape of the Reduced Sugar Food & Beverages Market is shaped by a combination of established industry leaders and emerging players, all contributing to meet the increasing consumer demand for healthier and reduced-sugar alternatives. As of 2023, key players in the market have strategically positioned themselves to address changing dietary preferences, regulatory shifts, and a growing awareness of the health impacts of excessive sugar consumption.

The Competitive Landscape of the Reduced Sugar Food & Beverages Market is shaped by a combination of established industry leaders and emerging players, all contributing to meet the increasing consumer demand for healthier and reduced-sugar alternatives. As of 2023, key players in the market have strategically positioned themselves to address changing dietary preferences, regulatory shifts, and a growing awareness of the health impacts of excessive sugar consumption.

Key Players:

Bunge Limited

Nestle SA (US)

PepsiCo Inc. (US),

Coca Cola (US),

Kraft Heinz (US),

Kellogg Company (US),

The Hershey Company (US),

Conagra Brand (US),

Mars Inc. (Virginia),

Unilever (UK),

Mondeleze International Inc

Wangkanai Sugar Co. Ltd

Strategies Adopted:

Strategies adopted by key players in the Reduced Sugar Food & Beverages Market revolve around reformulation, innovation, and marketing. Reformulation involves adjusting existing recipes to reduce sugar content while maintaining taste and texture. Innovation strategies include introducing new products with reduced sugar content, leveraging alternative sweeteners, and incorporating natural ingredients. Marketing efforts focus on promoting the health benefits of reduced-sugar options, educating consumers, and aligning with broader health and wellness trends.

Market Share Analysis:

The Reduced Sugar Food & Beverages Market is influenced by factors such as brand loyalty, product quality, pricing, and distribution networks. Companies with strong brand recognition often have a competitive advantage, as consumers tend to choose trusted brands when exploring reduced-sugar alternatives. Quality assurance practices, including transparency in ingredient sourcing and adherence to nutritional standards, contribute significantly to gaining and retaining market share. Competitive pricing strategies, balancing affordability with perceived quality, are essential for attracting a broad consumer base. Efficient distribution networks and strategic partnerships with retailers enhance a company's competitive position.

New & Emerging Companies:

The Reduced Sugar Food & Beverages Market contribute to the competitive landscape by focusing on niche markets, novel ingredients, and innovative formulations. Start-ups such as Zevia and Hint have entered the market, offering sugar-free and naturally flavored beverages that cater to health-conscious consumers. While these companies may initially have smaller market shares compared to industry giants, their emphasis on clean labels, natural sweeteners, and reduced-sugar options makes them noteworthy contributors to market diversity.

Industry Trends:

Industry trends provide insights into ongoing developments within the Reduced Sugar Food & Beverages Market. A notable trend in 2023 is the increasing emphasis on plant-based sweeteners and natural sugar substitutes. Key players are investing in research and development to explore alternative sweeteners like stevia, monk fruit, and erythritol as viable replacements for traditional sugars. Additionally, investments in marketing campaigns promoting the reduced sugar content of products underscore the industry's commitment to responding to consumer preferences for healthier choices.

Competitive Scenario:

The Reduced Sugar Food & Beverages Market remains dynamic, with companies adopting diverse strategies to gain a competitive edge. There is a notable emphasis on digital marketing and e-commerce, with companies leveraging online platforms to communicate health benefits, engage with consumers, and offer convenient ways to purchase reduced-sugar products. Additionally, companies are exploring opportunities for collaboration and partnerships, such as joint ventures with wellness-focused brands or tie-ins with health and fitness influencers, to enhance brand visibility and market reach.

Recent Development

The Reduced Sugar Food & Beverages Market is the increased integration of technology in product development. Key players are utilizing artificial intelligence and data analytics to understand consumer preferences, predict trends, and optimize formulations for reduced-sugar products. This development reflects the industry's acknowledgment of the role technology plays in adapting to consumer demands and staying ahead in a competitive market.