Regulatory Compliance

The Rail Asset Management Market is significantly influenced by stringent regulatory frameworks aimed at ensuring safety and efficiency in rail operations. Governments and regulatory bodies are increasingly mandating the implementation of advanced asset management systems to comply with safety standards and operational guidelines. This regulatory pressure compels rail operators to invest in modern asset management solutions, which can track and manage assets effectively. The market is projected to expand as companies strive to meet these compliance requirements, with an estimated increase in investment in asset management technologies by 20% over the next five years. Consequently, the need for compliance-driven solutions is a key driver of growth in the rail asset management sector.

Sustainability Initiatives

The Rail Asset Management Market is witnessing a growing emphasis on sustainability initiatives, as rail operators aim to reduce their carbon footprint and enhance energy efficiency. The shift towards greener transportation solutions is prompting investments in asset management systems that optimize resource utilization and minimize waste. For instance, the implementation of energy-efficient technologies in rail operations can lead to a reduction in energy consumption by approximately 15%. As environmental concerns become more pronounced, the demand for sustainable asset management practices is expected to rise, potentially increasing market growth by 25% in the coming years. This focus on sustainability is reshaping the landscape of the rail asset management market.

Technological Advancements

The Rail Asset Management Market is experiencing a surge in technological advancements, particularly in the realm of predictive maintenance and asset tracking. Innovations such as the Internet of Things (IoT) and artificial intelligence (AI) are being integrated into rail systems, enabling real-time monitoring and data analysis. This integration allows for proactive maintenance strategies, reducing downtime and operational costs. According to recent estimates, the adoption of advanced technologies in rail asset management could lead to a reduction in maintenance costs by up to 30%. As rail operators seek to enhance efficiency and reliability, the demand for sophisticated asset management solutions is likely to grow, driving the market forward.

Growing Demand for Data Analytics

The Rail Asset Management Market is increasingly driven by the growing demand for data analytics in rail operations. Rail operators are recognizing the value of data-driven insights to enhance decision-making processes and optimize asset performance. The integration of big data analytics into asset management systems allows for improved forecasting, risk assessment, and operational efficiency. It is estimated that the use of data analytics in rail asset management could enhance operational efficiency by up to 20%. As the industry continues to evolve, the reliance on data analytics is likely to intensify, further propelling the growth of the rail asset management market.

Increased Investment in Infrastructure

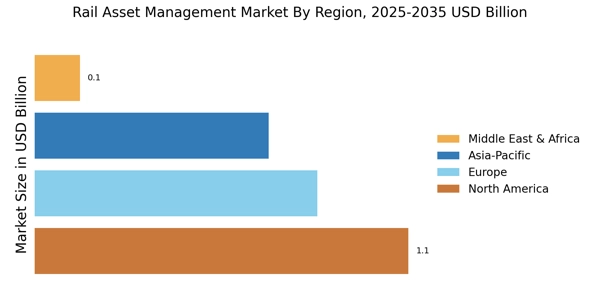

The Rail Asset Management Market is benefiting from increased investment in rail infrastructure across various regions. Governments and private entities are recognizing the importance of modernizing rail systems to enhance connectivity and efficiency. This influx of capital is driving the demand for advanced asset management solutions that can effectively monitor and maintain infrastructure assets. Recent reports indicate that infrastructure investments in rail are projected to reach unprecedented levels, with an estimated growth rate of 10% annually. As rail networks expand and modernize, the need for robust asset management systems becomes critical, positioning the market for substantial growth in the near future.