Technological Advancements

The Global Proximity Sensor Market Industry is experiencing rapid growth driven by technological advancements in sensor technology. Innovations such as capacitive and ultrasonic sensors are enhancing the accuracy and efficiency of proximity detection. For instance, the integration of IoT in sensor applications is enabling real-time data collection and analysis, which is crucial for industries such as automotive and consumer electronics. As a result, the market is projected to reach 5.27 USD Billion in 2024, reflecting a growing demand for smarter and more efficient sensing solutions. This trend indicates a shift towards automation and improved user experiences across various sectors.

Growth in Industrial Automation

The Global Proximity Sensor Market Industry is significantly influenced by the growth of industrial automation. Proximity sensors play a crucial role in manufacturing processes, enabling automation in assembly lines, material handling, and robotics. Their ability to detect the presence of objects without physical contact enhances operational efficiency and reduces downtime. As industries continue to adopt automation technologies to improve productivity, the demand for proximity sensors is expected to rise. This trend aligns with the broader movement towards Industry 4.0, where smart manufacturing practices are becoming increasingly prevalent, further driving the market's expansion.

Rising Demand in Automotive Sector

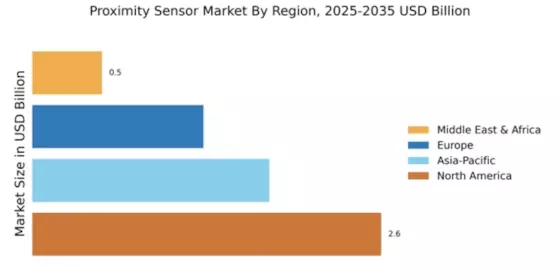

The automotive sector is a significant driver of the Global Proximity Sensor Market Industry, as manufacturers increasingly incorporate these sensors into vehicles for enhanced safety and convenience features. Proximity sensors are utilized in parking assistance systems, collision avoidance, and adaptive cruise control, contributing to improved vehicle functionality. The growing emphasis on vehicle safety regulations and consumer preferences for advanced driver-assistance systems (ADAS) are propelling this demand. By 2035, the market is expected to expand substantially, potentially reaching 10.5 USD Billion, highlighting the automotive industry's pivotal role in the growth of proximity sensor technologies.

Emerging Applications in Healthcare

Emerging applications of proximity sensors in the healthcare sector are contributing to the growth of the Global Proximity Sensor Market Industry. These sensors are being utilized in various medical devices for patient monitoring, automated medication dispensing, and contactless interactions, which enhance patient safety and care. The increasing focus on improving healthcare outcomes and the adoption of telemedicine solutions are likely to drive demand for these sensors. As healthcare technology continues to evolve, the integration of proximity sensors into medical applications may provide new opportunities for market expansion, reflecting a growing recognition of their value in enhancing healthcare delivery.

Increasing Adoption in Consumer Electronics

The Global Proximity Sensor Market Industry is witnessing a surge in adoption within the consumer electronics sector, particularly in smartphones and smart home devices. Proximity sensors enhance user interaction by enabling features such as screen dimming during calls and automated lighting in smart homes. As consumer preferences shift towards more intuitive and responsive devices, manufacturers are increasingly integrating these sensors into their products. This trend is likely to contribute to a compound annual growth rate (CAGR) of 6.5% from 2025 to 2035, indicating a robust growth trajectory driven by innovation and consumer demand in the electronics market.