Rising Demand for Automation

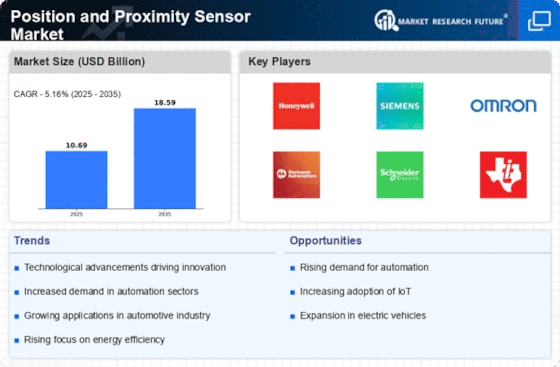

The Position and Proximity Sensor Market is experiencing a notable surge in demand for automation across various sectors, including manufacturing, automotive, and consumer electronics. This trend is driven by the need for enhanced efficiency and productivity. As industries increasingly adopt automated systems, the reliance on position and proximity sensors becomes paramount. For instance, the manufacturing sector is projected to witness a compound annual growth rate (CAGR) of approximately 7% over the next few years, largely fueled by automation initiatives. These sensors play a critical role in ensuring precise control and monitoring of machinery, thereby reducing operational costs and minimizing human error. Consequently, the growing emphasis on automation is likely to propel the Position and Proximity Sensor Market forward, as companies seek to integrate advanced sensor technologies into their operations.

Increasing Focus on Smart Manufacturing

The Position and Proximity Sensor Market is benefiting from the increasing focus on smart manufacturing practices. As industries transition towards Industry 4.0, the integration of sensors into manufacturing processes is becoming more prevalent. Smart factories utilize position and proximity sensors to monitor equipment, track inventory, and optimize production lines. This shift towards interconnected systems is expected to enhance operational efficiency and reduce downtime. According to industry reports, the smart manufacturing market is projected to grow significantly, with a substantial portion attributed to sensor technologies. The Position and Proximity Sensor Market is likely to thrive as manufacturers seek to implement smart solutions that leverage real-time data for decision-making and process improvement.

Expansion of Consumer Electronics Market

The Position and Proximity Sensor Market is also experiencing growth due to the expansion of the consumer electronics market. With the increasing prevalence of smart devices, such as smartphones, tablets, and wearables, the demand for position and proximity sensors is on the rise. These sensors are integral to various applications, including touchless controls, gesture recognition, and device orientation. The consumer electronics sector is expected to witness a CAGR of approximately 6% in the coming years, driven by technological innovations and changing consumer preferences. As manufacturers strive to enhance user experiences through advanced features, the Position and Proximity Sensor Market is likely to benefit from this trend, as more devices incorporate sophisticated sensor technologies.

Growing Adoption in Automotive Applications

The automotive sector is a key driver for the Position and Proximity Sensor Market, as the demand for advanced safety features and automation continues to rise. Modern vehicles increasingly incorporate position and proximity sensors for applications such as parking assistance, collision avoidance, and adaptive cruise control. The Position and Proximity Sensor is projected to grow at a CAGR of around 8% through the next few years, with position and proximity sensors playing a crucial role in enhancing vehicle safety and performance. As manufacturers strive to meet stringent safety regulations and consumer expectations, the integration of these sensors is becoming essential. This trend is likely to bolster the Position and Proximity Sensor Market, as automotive companies invest in innovative sensor solutions to improve vehicle functionality and safety.

Technological Advancements in Sensor Technology

Technological advancements are significantly shaping the Position and Proximity Sensor Market. Innovations in sensor technology, such as the development of more sensitive and accurate sensors, are enhancing their applicability across various sectors. For example, the introduction of laser-based proximity sensors has improved detection capabilities, allowing for more precise measurements in challenging environments. Furthermore, the integration of smart technologies, including artificial intelligence and machine learning, is enabling sensors to provide real-time data analytics. This evolution is expected to drive market growth, as industries increasingly seek to leverage advanced sensor technologies to optimize processes. The market for position and proximity sensors is anticipated to reach a valuation of USD 3 billion by 2026, reflecting the impact of these technological advancements on the Position and Proximity Sensor Market.