Advancements in Diagnostic Technologies

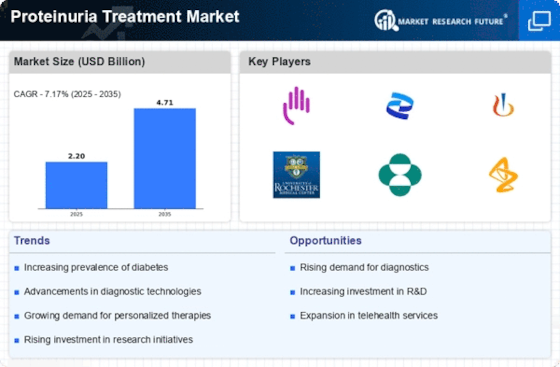

Technological advancements in diagnostic tools are significantly influencing the Proteinuria Treatment Market. Innovations such as point-of-care testing and advanced imaging techniques enable earlier and more accurate detection of proteinuria. These developments not only enhance patient outcomes but also facilitate timely intervention, which is crucial in managing kidney-related conditions. The market for diagnostic devices is projected to grow, with estimates suggesting a compound annual growth rate of over 8% in the coming years. As healthcare providers increasingly adopt these technologies, the Proteinuria Treatment Market is expected to benefit from improved patient management and treatment efficacy.

Growing Awareness and Education Initiatives

The rise in awareness and education initiatives surrounding kidney health is a significant driver for the Proteinuria Treatment Market. Campaigns aimed at educating the public about the risks associated with proteinuria and CKD are gaining traction. These initiatives are likely to lead to increased screening and diagnosis rates, thereby expanding the patient population requiring treatment. Furthermore, healthcare organizations are investing in educational programs to inform both patients and providers about the importance of early detection and management of proteinuria. This heightened awareness is expected to stimulate demand for various treatment options within the Proteinuria Treatment Market.

Rising Prevalence of Chronic Kidney Diseases

The increasing incidence of chronic kidney diseases (CKD) is a primary driver for the Proteinuria Treatment Market. As CKD affects millions worldwide, the demand for effective treatment options is surging. According to recent data, approximately 10% of the population is affected by CKD, leading to a heightened focus on proteinuria as a key indicator of kidney health. This trend is likely to propel the market forward, as healthcare providers seek innovative therapies to manage proteinuria and its underlying causes. The growing awareness of kidney health and the importance of early detection further contribute to the expansion of the Proteinuria Treatment Market, as patients and healthcare systems prioritize proactive management strategies.

Increased Investment in Research and Development

Investment in research and development (R&D) for novel therapies is a crucial factor propelling the Proteinuria Treatment Market. Pharmaceutical companies are focusing on developing targeted therapies that address the underlying causes of proteinuria, which may lead to more effective treatment options. The market is witnessing a surge in clinical trials aimed at evaluating new drugs and treatment modalities. This trend is supported by the growing recognition of proteinuria as a critical biomarker for kidney disease progression. As R&D efforts intensify, the Proteinuria Treatment Market is poised for growth, with the potential introduction of innovative therapies that could transform patient care.

Aging Population and Associated Health Challenges

The aging population presents a substantial driver for the Proteinuria Treatment Market. As individuals age, the risk of developing kidney-related issues, including proteinuria, increases significantly. This demographic shift is expected to lead to a higher prevalence of CKD and related conditions, thereby driving demand for effective treatment solutions. Projections indicate that by 2030, the number of individuals aged 65 and older will reach over 1 billion, further emphasizing the need for targeted interventions in the Proteinuria Treatment Market. Healthcare systems are likely to adapt to these demographic changes by prioritizing kidney health, which will, in turn, stimulate market growth.