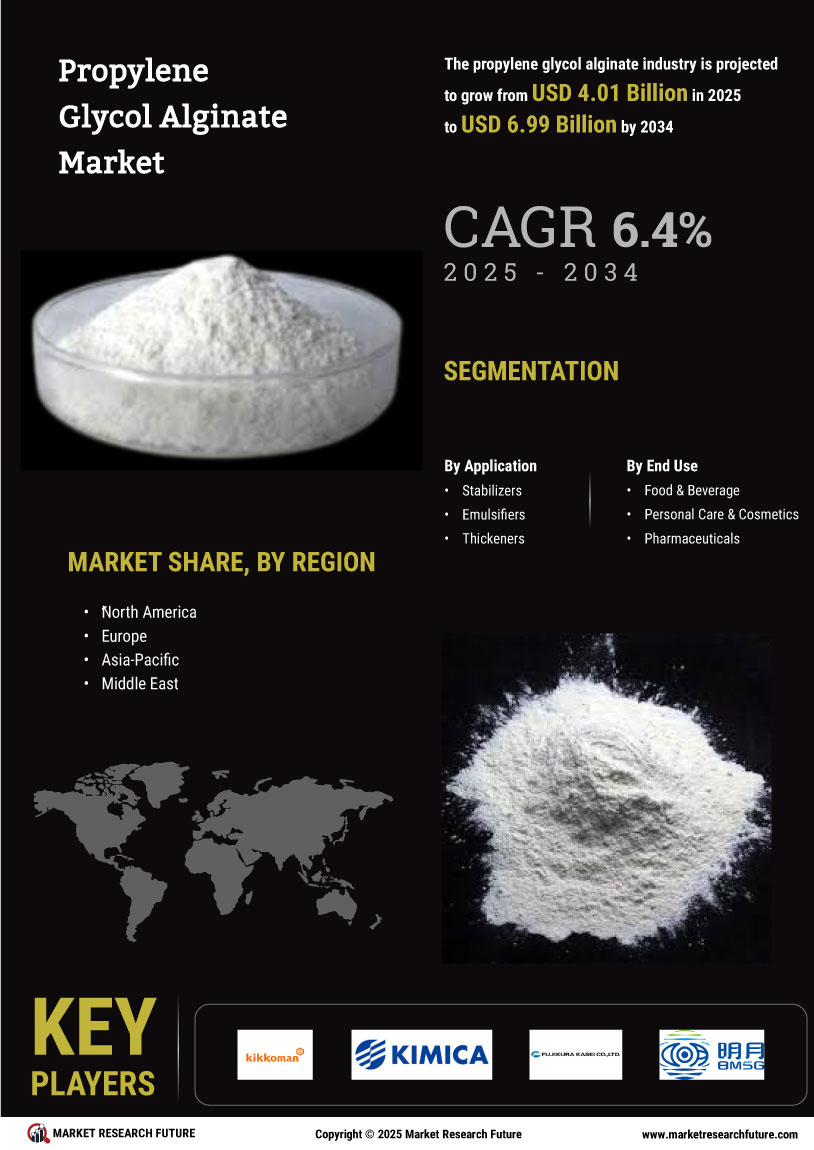

Market Growth Projections

The Global Propylene Glycol Alginate Market Industry is projected to experience substantial growth over the coming years. The market is expected to reach a valuation of 3.77 USD Billion in 2024, with a significant increase anticipated by 2035, potentially reaching 7.44 USD Billion. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 6.37% from 2025 to 2035. Such projections indicate a strong demand across various sectors, including food, pharmaceuticals, and personal care, driven by the ingredient's versatility and increasing consumer preference for natural products.

Rising Demand in Food Industry

The Global Propylene Glycol Alginate Market Industry experiences a notable surge in demand from the food sector, where it serves as a thickening and stabilizing agent. This trend is driven by the increasing consumer preference for natural and clean-label products. For instance, propylene glycol alginate is utilized in various food applications, including sauces, dressings, and dairy products. As the market evolves, the industry is projected to reach a valuation of 3.77 USD Billion in 2024, reflecting the growing incorporation of this ingredient in food formulations. This demand is likely to continue, contributing to the overall growth of the market.

Growth in Personal Care Products

The Global Propylene Glycol Alginate Market Industry is also benefitting from the rising incorporation of propylene glycol alginate in personal care products. This ingredient is valued for its emulsifying and thickening properties, making it a popular choice in cosmetics and skincare formulations. With consumers increasingly seeking products that are both effective and safe, the demand for natural ingredients is on the rise. This trend is likely to drive the market forward, as propylene glycol alginate aligns with the clean beauty movement. The anticipated growth in this segment may further enhance the overall market dynamics, contributing to a robust CAGR of 6.37% from 2025 to 2035.

Expansion in Pharmaceutical Applications

The Global Propylene Glycol Alginate Market Industry is witnessing significant growth due to its expanding applications in the pharmaceutical sector. Propylene glycol alginate is utilized as a stabilizer and emulsifier in various drug formulations, enhancing the bioavailability of active ingredients. The increasing focus on developing novel drug delivery systems is likely to propel the demand for this ingredient. As the pharmaceutical industry continues to innovate, the market for propylene glycol alginate is expected to flourish, potentially contributing to the projected market size of 7.44 USD Billion by 2035. This growth underscores the ingredient's versatility and importance in modern pharmaceuticals.

Technological Advancements in Production

The Global Propylene Glycol Alginate Market Industry is influenced by ongoing technological advancements in the production processes of propylene glycol alginate. Innovations in extraction and purification techniques are enhancing the efficiency and quality of this ingredient, making it more accessible for various applications. As manufacturers adopt these advanced technologies, the production costs may decrease, potentially leading to increased market penetration. This shift could stimulate demand across multiple sectors, including food, pharmaceuticals, and personal care. The positive impact of these advancements is expected to be reflected in the market's growth trajectory, aligning with the projected increase in market size.

Regulatory Support for Natural Ingredients

The Global Propylene Glycol Alginate Market Industry benefits from favorable regulatory frameworks that support the use of natural ingredients in various applications. Regulatory bodies are increasingly endorsing the use of propylene glycol alginate as a safe and effective additive in food, pharmaceuticals, and cosmetics. This regulatory backing is likely to enhance consumer confidence and drive demand for products containing this ingredient. As the market continues to evolve, the alignment of propylene glycol alginate with regulatory standards may facilitate its adoption across diverse sectors, further contributing to the anticipated growth of the market.