Expansion in the Food Industry

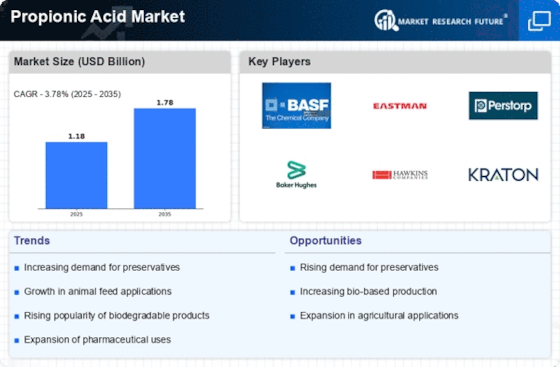

The Propionic Acid Market is witnessing expansion due to the increasing utilization of propionic acid in the food sector. As a food preservative, propionic acid is valued for its ability to inhibit mold and bacterial growth, thereby extending the shelf life of baked goods and other perishable items. The global food industry is projected to grow, with a rising focus on food safety and quality. This trend is expected to drive the demand for propionic acid, particularly in regions with stringent food safety regulations. Furthermore, the market for organic and natural food products is also expanding, and propionic acid's natural origins may appeal to manufacturers seeking to meet consumer preferences. The food industry’s growth is anticipated to significantly influence the Propionic Acid Market, as manufacturers increasingly incorporate propionic acid into their formulations.

Increasing Demand for Animal Feed

The Propionic Acid Market is experiencing a notable surge in demand for animal feed additives. Propionic acid serves as an effective preservative, enhancing the shelf life of feed products. This is particularly relevant in regions where livestock farming is prevalent, as the need for high-quality feed is paramount. According to recent data, the animal feed segment is projected to account for a significant share of the propionic acid market, driven by the rising global population and the consequent increase in meat consumption. The ability of propionic acid to inhibit mold growth in feed products further solidifies its position in the market. As livestock producers seek to improve feed efficiency and animal health, the demand for propionic acid as a feed additive is likely to grow, thereby propelling the overall Propionic Acid Market.

Growth in Pharmaceutical Applications

The Propionic Acid Market is also witnessing growth in pharmaceutical applications, where propionic acid is utilized as an intermediate in the synthesis of various drugs. The increasing focus on research and development in the pharmaceutical sector is driving the demand for propionic acid, as it plays a crucial role in the production of certain medications. Moreover, the rise in chronic diseases and the aging population are contributing to the expansion of the pharmaceutical market, which in turn is likely to enhance the demand for propionic acid. As pharmaceutical companies seek reliable and effective intermediates, the Propionic Acid Market is expected to benefit from this trend, potentially leading to increased production and consumption of propionic acid in the coming years.

Rising Awareness of Health and Safety

The Propionic Acid Market is benefiting from a growing awareness of health and safety standards among consumers and manufacturers alike. As food safety becomes a priority, the demand for effective preservatives like propionic acid is likely to increase. This compound is recognized for its efficacy in preventing spoilage and ensuring product safety, which aligns with the heightened focus on health-conscious consumption. Additionally, regulatory bodies are implementing stricter guidelines regarding food additives, which may further drive the adoption of propionic acid in various applications. The emphasis on maintaining high safety standards in food production and storage is expected to bolster the Propionic Acid Market, as manufacturers seek reliable solutions to meet these evolving requirements.

Technological Innovations in Production Processes

The Propionic Acid Market is poised for growth due to ongoing technological innovations in production processes. Advances in manufacturing techniques are enhancing the efficiency and cost-effectiveness of propionic acid production. For instance, the development of biotechnological methods for synthesizing propionic acid is gaining traction, potentially reducing environmental impact and production costs. These innovations may lead to increased availability and lower prices for propionic acid, making it more accessible to various industries. As production processes become more streamlined, the Propionic Acid Market is likely to experience a boost in demand from sectors such as food preservation and agriculture, where cost-effective solutions are essential.