Top Industry Leaders in the Propionic Acid Market

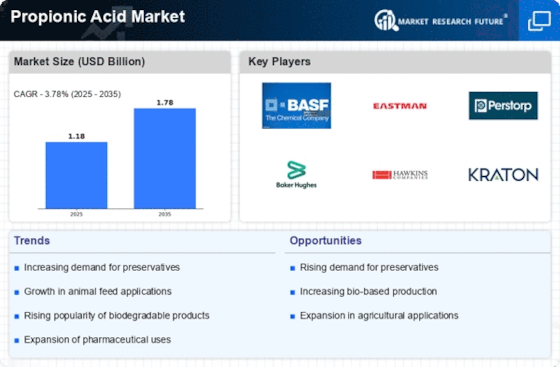

The propionic acid market, valued at an estimated 412.06 kilotons in 2024, is a dynamic space pulsating with competitive energy. As demand for its diverse applications across industries thrives, so too does the fight for market share. Let's delve into the strategies at play, the factors shaping dominance, and the recent developments brewing in this fertile field.

The propionic acid market, valued at an estimated 412.06 kilotons in 2024, is a dynamic space pulsating with competitive energy. As demand for its diverse applications across industries thrives, so too does the fight for market share. Let's delve into the strategies at play, the factors shaping dominance, and the recent developments brewing in this fertile field.

Strategies Shaping the Arena:

-

Innovation Reigns Supreme: Companies like Cargill and BASF are pushing the boundaries with bio-based propionic acid production, catering to the rising sustainability-conscious market. Others, like Eastman Chemical, are focusing on developing specialty derivatives with enhanced functionality. -

Geographic Expansion Takes Center Stage: Expansion into untapped markets like China and India is a key strategy. Companies like Kemira and Lonza are actively setting up production facilities in these regions to capitalize on the burgeoning demand. -

Mergers and Acquisitions Fuel Growth: Strategic acquisitions are playing a crucial role in consolidating market power. Westlake Chemical's acquisition of Axiall Corporation in 2019 is a prime example, boosting its position as a key propionic acid player. -

Vertical Integration for Cost Optimization: Integrating upstream and downstream operations strengthens control over the value chain and optimizes costs. Companies like LyondellBasell are actively integrating with feedstock suppliers and downstream partners to gain a competitive edge.

Factors Dictating Market Share:

-

Application Diversification: Diversifying beyond traditional applications like animal feed preservatives and herbicides helps mitigate risk and tap into new growth avenues. Propionic acid's increasing use in pharmaceuticals, food additives, and industrial chemicals is a prime example. -

Technological Advancements: Developing efficient and cost-effective production processes provides a significant advantage. Investments in fermentation technology and biomass-based production are key areas of focus. -

Regulatory Landscape: Navigating the complex regulatory landscape surrounding propionic acid production and usage is crucial. Compliance with safety and environmental regulations is paramount for long-term success. -

Regional Dynamics: Understanding and adapting to regional demand patterns and price fluctuations is essential. Emerging markets like Asia Pacific are expected to drive significant growth in the coming years.

Key Companies in the Propionic Acid market includes

- BASF Se (GERMANY)

- The Dow Chemical Company (US)

- Eastman Chemical Company (US)

- Oxea GMBH (GERMANY)

- PERSTORP ORGNR (SWEDEN)

- Krishna Chemicals (INDIA)

- Celanese Corporation (US)

- BIOMIN HOLDING GMBH (AUSTRIA)

- M. FOOD CHEMICAL CO. LTD (CHINA)

- DAICEL CORPORATION (JAPAN), among others

Recent Developments:

-

August 2023: BASF announces plans to invest €300 million in expanding its propionic acid production capacity in Germany. -

September 2023: Cargill partners with a leading Chinese animal feed company to provide bio-based propionic acid for the Chinese market. -

October 2023: US Department of Agriculture approves the use of propionic acid as a fungicide for certain fruits and vegetables, boosting its application in the food industry. -

November 2023: Temporary production halt at a major propionic acid plant in Europe due to technical issues leads to a short-term price hike. -

December 2023: Lonza expands its propionic acid distribution network in Southeast Asia, aiming to capture the growing demand in the region. -

January 2024: New research published in a scientific journal highlights the potential of propionic acid in developing novel drugs for cancer treatment, opening up a new frontier for market growth.