Emergence of Edge Computing

The emergence of edge computing is reshaping the landscape of the Programmable Logic Device Pld Market. As data processing shifts closer to the source of data generation, the need for efficient and adaptable processing solutions becomes evident. PLDs are uniquely positioned to facilitate this transition, offering the flexibility required for real-time data analysis and decision-making at the edge. Industries such as manufacturing and healthcare are increasingly adopting edge computing solutions, which in turn drives the demand for PLDs that can support these applications. The market for edge computing is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 30% in the coming years. This growth presents a substantial opportunity for PLD manufacturers to innovate and cater to the specific needs of edge computing applications.

Increased Focus on Automation

The rising focus on automation across various sectors is a pivotal driver for the Programmable Logic Device Pld Market. As industries strive to enhance productivity and reduce operational costs, the adoption of automated systems is becoming more prevalent. PLDs play a crucial role in enabling automation by providing the necessary logic functions to control and monitor processes. The industrial automation market is expected to witness substantial growth, with projections indicating a value exceeding 300 billion dollars by 2027. This growth is likely to be accompanied by an increased demand for PLDs that can support complex automation tasks. Consequently, manufacturers are investing in developing advanced PLD solutions that cater to the specific requirements of automation, thereby reinforcing the importance of PLDs in this evolving landscape.

Growth in Consumer Electronics

The proliferation of consumer electronics is a significant driver for the Programmable Logic Device Pld Market. With the increasing integration of smart technologies in everyday devices, the demand for PLDs is on the rise. Products such as smartphones, smart home devices, and wearables require sophisticated logic functions that PLDs can provide. The market for consumer electronics is anticipated to reach over 1 trillion dollars by 2026, with a substantial portion of this growth attributed to the incorporation of programmable logic solutions. As manufacturers strive to enhance product features and performance, the reliance on PLDs for rapid development and deployment becomes increasingly critical. This trend underscores the essential role of PLDs in meeting the evolving demands of the consumer electronics sector.

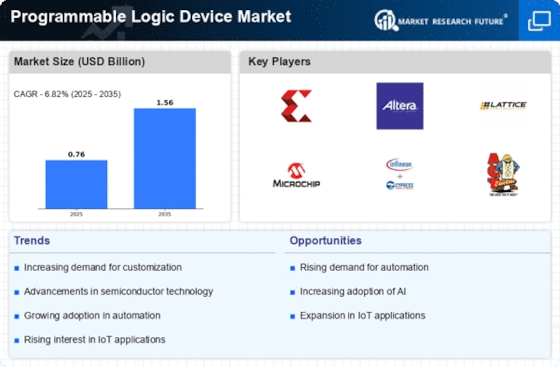

Rising Demand for Customization

The Programmable Logic Device Pld Market is experiencing a notable surge in demand for customized solutions. As industries increasingly seek tailored applications, the flexibility offered by PLDs becomes paramount. This customization allows for the development of specific functionalities that meet unique operational requirements. For instance, sectors such as automotive and telecommunications are leveraging PLDs to create specialized hardware that enhances performance and efficiency. The market for PLDs is projected to grow at a compound annual growth rate of approximately 7.5% over the next five years, driven by this need for bespoke solutions. Consequently, manufacturers are investing in advanced design tools and software to facilitate rapid prototyping and deployment, further solidifying the role of PLDs in various applications.

Advancements in Semiconductor Technology

Technological advancements in semiconductor manufacturing are significantly influencing the Programmable Logic Device Pld Market. Innovations such as smaller process nodes and improved fabrication techniques are enabling the production of more powerful and efficient PLDs. These advancements allow for higher integration levels, leading to increased functionality within smaller form factors. As a result, the market is witnessing a shift towards more compact and energy-efficient devices, which are essential for modern applications in consumer electronics and industrial automation. The introduction of 5nm and 7nm process technologies is expected to enhance the performance of PLDs, making them more attractive to designers and engineers. This trend is likely to propel the market forward, as companies seek to capitalize on the benefits of cutting-edge semiconductor technology.