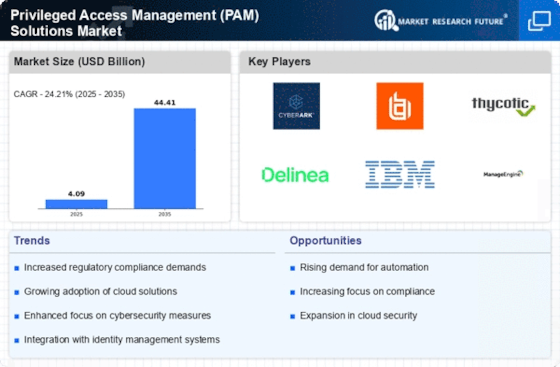

Leading market players are largely investing in research and development to expand their product lines, which will help the privileged access management (PAM) solutions market, grow even more. The launch of new products, larger-scale mergers and acquisitions, contractual agreements, and collaboration with other organizations are significant market developments in which market participants engage to increase their presence. The privileged access management (PAM) solutions industry must provide affordable products to expand and thrive in a more competitive and challenging market environment.

One of the major business strategies manufacturers use in the privileged access management (PAM) solutions industry to increase market sector and benefits customers is local manufacturing to lower operational costs. In recent years, the privileged access management (PAM) solutions industry has stipulated some of the most important medicinal benefits. Major players in the privileged access management (PAM) solutions market, including Hitachi ID Systems, ARCON, Centrify, CA Technologies, and others, are attempting to increase market demand by heavily investing in research and development operations.

CyberArk Software Ltd offers information technology security solutions to protect the company's data, infrastructure, and assets. The company's software solutions were centered on safeguarding credentials, privileged accounts, and secrets. Its products and services include Privileged Session Manager, Privileged Threat Analytics, Enterprise Password Vault, and CyberArk Privilege Cloud.

In May CyberArk Software Ltd., a US-based provider of privileged access control systems, acquired IDaptive Holdings Inc. for an undisclosed sum.

Through this acquisition, CyberArk Software Ltd. seeks to enhance its capacity to manage and secure identities with varied degrees of privileges across hybrid and multi-cloud systems to give customers an efficient and seamless user experience in supplying security.

Centrify is now Delinea, a leading provider of privileged access management (PAM) solutions for the modern, hybrid enterprise. They let businesses secure essential data, devices, code, and cloud infrastructure, reducing risk, ensuring compliance, and simplifying security. Delinea simplifies and specifies access boundaries for thousands of consumers worldwide.

In September Centrify Privilege Service, a cloud-based privileged access security solution, now supports hybrid IT systems (on-premises and cloud). CPS complements and extends the flagship Centrify Server Suite's broad capabilities for identity consolidation, privilege management, and privileged session auditing by providing shared account password management for servers, network devices, and Infrastructure-as-a-Service (IaaS).