Market Trends

Introduction

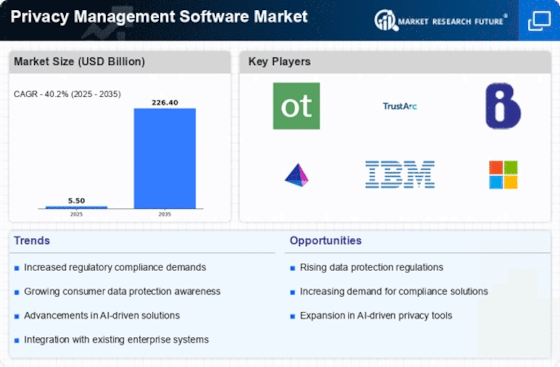

In 2022, the global privacy management software market is undergoing a transformation driven by a confluence of macroeconomic factors, including technological developments, increased regulatory pressures, and changing consumer behavior. With the complexities of privacy compliance rising, the demand for comprehensive privacy management solutions has increased. Business are being forced to adopt more comprehensive privacy strategies in order to comply with the General Data Protection Regulation and the Californian Personal Information Protection Act. The increasing awareness of consumers about the protection of their personal data is also putting pressure on organizations to adopt more transparent and accountable practices. These trends are strategically important for the market's key players, as they not only influence operational practices but also shape the positioning of businesses in the increasingly privacy-conscious marketplace.

Top Trends

-

Increased Regulatory Compliance Demands

The regulations of the governments of the world are becoming more and more stringent in the matter of data privacy. The GDPR in Europe and the CCPA in California are the best known. Companies are investing heavily in tools for compliance, and in the last two years, seven out of ten companies have increased their spending on privacy management tools. This trend has led to an increase in the number of tools on the market to meet the new legal requirements. There are also signs that new regulations will complicate compliance in the future. -

Integration of AI and Machine Learning

Machine learning and artificial intelligence are incorporated into privacy management software in order to automate data discovery and risk assessment. BigID, for example, has incorporated artificial intelligence to enhance its data mapping functionality, resulting in a 50% reduction in the amount of time required for data discovery. This trend is expected to result in greater accuracy and efficiency in compliance processes, and pave the way for the development of more advanced privacy solutions. -

Focus on Data Minimization Strategies

The data minimization principle has been gaining ground in the data protection field. This principle limits the collection and use of personal data. By the demand for privacy protection and by the pressure of legislation, this trend has been brought about. A survey has shown that 65% of consumers prefer companies that collect the least data. The development of data protection management systems supports this trend and can lead to lower costs for data storage and lower risks for data protection. -

Enhanced User Consent Management

With the growing importance of data privacy, the management of user consent has become critical. Some companies, like OneTrust, are offering solutions that make it easier to manage the consent process. There is evidence that if the consent process is clear and easy to understand, a customer is more likely to engage with a brand. The trend towards innovation in consent management is likely to lead to improvements in the level of trust and engagement with the customer. -

Growing Demand for Third-Party Risk Management

Third-party data risks are becoming an increasingly important concern for organizations that are increasingly dependent on third-party suppliers. A study found that over 60% of data breaches involve third-party suppliers. This has led companies to seek more robust data protection solutions. The development of tools that assess and monitor third-party compliance could reduce the risk of data breaches in the future. -

Shift Towards Privacy by Design

Among the organizations which are establishing the concept of privacy by design, the first to realize the importance of a process of data privacy is the telecommunications industry. The General Data Protection Regulation, which mandates that privacy be taken into account in the development of products, encourages this approach. Those who have adopted this strategy report a better compliance and more customer trust, and this shows a change in the integration of privacy in the business process. In the future, more companies may adopt this approach. -

Rise of Privacy-Centric Business Models

Business is increasingly adopting a privacy-centric approach, and seeing the protection of customer data as a source of competitive advantage. For example, Securiti.ai is a start-up that offers a comprehensive solution for privacy, transparency and control. A recent study found that 75% of consumers are prepared to pay more for a service which gives priority to their privacy. This trend will have a significant impact on the market, as it will encourage more companies to focus on privacy-related innovation. -

Increased Investment in Privacy Training

Companies are becoming increasingly aware of the need for employees to be fully trained in data protection to ensure compliance with data protection regulations. A recent survey showed that 55% of companies intend to increase their investment in training. This trend is expected to lead to a reduction in the number of data breaches caused by human error, and a more privacy-conscious company culture. -

Emergence of Privacy-Enhancing Technologies

PETs, privacy-enhancing technologies, are gaining in popularity as organizations look to protect their users’ data while still being able to use it for analytics. Industry leaders are experimenting with differential privacy and homomorphic encryption. This report projects that the market for PETs will grow significantly. This trend could also result in new offerings in the privacy management space. -

Collaboration and Partnerships in Privacy Solutions

The necessary cooperation between the technical and legal experts is becoming more and more necessary for the proper functioning of the data protection system. In the field of data protection, these cooperations are based on the establishment of a partnership to jointly develop solutions to complex data protection problems. For example, IBM has established a partnership with several organizations to develop its data protection offerings. This trend is likely to lead to a higher degree of innovation and to the development of a more integrated data protection solution in the future.

Conclusion: Navigating the Privacy Software Landscape

The competition in the global privacy management software market will be very intense and highly fragmented in 2022. The market will be dominated by both the established players and the new entrants. Region-wise, the trend will be towards a greater focus on compliance and data security, especially in North America and Europe, where the regulatory pressure is mounting. Artificial intelligence will play a critical role in this respect, as will automation for streamlining processes. In addition, vendors must focus on developing advanced features such as compliance automation and data governance. These will be key to their future success. Similarly, the flexibility of deployment and integration will be a key to their continued success. The future leaders will be able to identify these capabilities and align their strategies accordingly.

Leave a Comment