Market Share

Introduction: Navigating the Competitive Landscape of Privacy Management Software

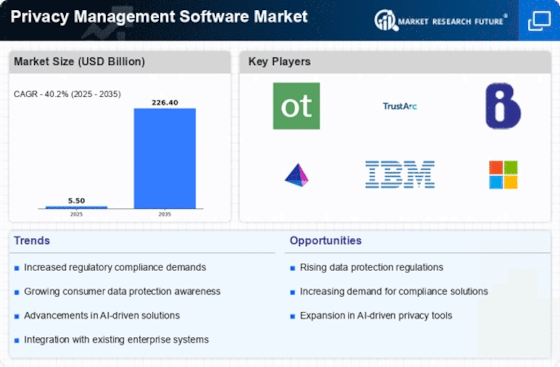

The privacy management software market is experiencing unprecedented growth, driven by a combination of technological innovation, regulatory change and increased consumer expectations. There are many players in the market, from established OEMs to agile IT system integrators to the newest artificial intelligence (AI) startups. The OEMs have the advantage of a well-established product portfolio and strong in-house expertise, while the IT system integrators are focused on the seamless deployment and integration of the privacy solutions. The AI-driven automation and analysis tools are becoming the key differentiators, helping to improve compliance and data governance processes. The IoT and biometrics are reshaping privacy management strategies and making the adoption of more sophisticated tools essential. Looking ahead to 2024–2025, we expect to see continued growth, especially in North America and Europe, where the regulatory framework is developing and strategic deployments are shifting towards cloud-based solutions and privacy ecosystems.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions that integrate various aspects of privacy management, providing end-to-end capabilities.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| One Trust, LLC | Robust compliance automation features | Privacy management and compliance | Global |

| IBM Corporation | Strong enterprise integration capabilities | Data privacy and security solutions | Global |

| TrustArc Inc. | Comprehensive privacy compliance tools | Privacy management and risk assessment | Global |

Specialized Technology Vendors

These vendors focus on niche areas within privacy management, offering specialized tools and technologies.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| BigID, Inc. | Advanced data discovery capabilities | Data privacy and protection | North America, Europe |

| Securiti.AI. | AI-driven privacy automation | Privacy management and data governance | Global |

| Nymity Inc. | Focus on accountability and compliance | Privacy compliance solutions | North America, Europe |

Consulting and Advisory Services

These vendors provide consulting services alongside technology solutions, helping organizations navigate privacy regulations.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Protiviti, Inc. | Expertise in risk and compliance | Consulting and advisory services | Global |

| SureCloud | Integrated risk management approach | Risk management and compliance | Europe, North America |

Infrastructure & Equipment Providers

These vendors offer foundational technologies that support privacy management solutions, focusing on data security and infrastructure.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| RSA Security LLC | Strong focus on cybersecurity | Data protection and security solutions | Global |

| Egnyte | Secure file sharing and collaboration | Data governance and security | North America, Europe |

| AvePoint, Inc. | Collaboration and compliance integration | Data management and compliance | Global |

Emerging Players & Regional Champions

- OneTrust (USA): A comprehensive data privacy management platform that provides solutions for data mapping, consent management, and risk assessment. Recent clients include major companies in the health care sector. The company is challenging the established players, such as TrustArc, with its more user-friendly interfaces and automation features.

- DataGrail (US): DataGrail specializes in privacy and compliance. It offers solutions for data discovery and consumer rights management. DataGrail has recently launched its platform for several mid-sized technology companies. It is a challenger to the larger companies, focusing on ease of integration and customer support.

- Privitar (UK): A specialist in privacy and data protection solutions, especially for analytics and data sharing. In recent times, the company has worked with financial institutions to enhance their data governance, offering advanced anonymization techniques to complement those of established vendors.

- Security: Provides AI-based privacy management solutions, including data discovery and compliance automation. They are now taking on the established players in the retail sector, using machine learning to gain deeper insights into their data.

- Clym (Europe): Offers a unique solution for consent management and user privacy preferences, recently adopted by several European startups. They complement established vendors by focusing on GDPR compliance and user-centric privacy solutions.

Regional Trends: In 2022, a great increase in the use of privacy-management tools is expected in North America and Europe, driven by the stricter regulations of the GDPR and the CCPA. Companies will seek to find solutions that not only guarantee compliance but also build trust with their customers. Hence, we expect to see a rise in the number of new entrants, offering specialized solutions with AI-based insights and easy-to-use interfaces, and thus presenting a more targeted and agile alternative to the established players.

Collaborations & M&A Movements

- The OneTrust and TrustArc companies have entered into a partnership to develop their privacy management solutions, with the goal of delivering a comprehensive compliance tool to companies subject to the growing number of privacy regulations, thereby strengthening their competitive position in the market.

- SAP acquired Signavio in 2022 to integrate process management capabilities into its privacy management offerings, enhancing its market share by providing customers with a more holistic approach to compliance and operational efficiency.

- During the course of the year, the two companies have announced a partnership that combines the use of artificial intelligence with the Salesforce platform to enable businesses to better manage their data privacy and compliance.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Data Mapping | OneTrust, TrustArc | OneTrust offers robust data mapping tools that help organizations visualize data flows and comply with regulations like GDPR. TrustArc provides automated data inventory capabilities, enhancing adoption rates among mid-sized firms. |

| Consent Management | Cookiebot, OneTrust | Cookiebot excels in providing customizable consent banners that integrate seamlessly with websites, leading to high user adoption. OneTrust's consent management module is noted for its comprehensive reporting features, aiding compliance audits. |

| Risk Assessment | LogicGate, RSA Archer | LogicGate's risk assessment tools are user-friendly and allow for quick implementation, making them popular among small businesses. RSA Archer is recognized for its extensive risk management framework, suitable for large enterprises. |

| Incident Response | IBM Security, ServiceNow | IBM Security provides an integrated incident response platform that leverages AI for faster resolution times. ServiceNow's incident management capabilities are praised for their automation features, enhancing operational efficiency. |

| Reporting and Analytics | BigID, OneTrust | BigID offers advanced analytics that help organizations identify data privacy risks through machine learning. OneTrust's reporting tools are highly customizable, allowing organizations to generate tailored compliance reports. |

| Training and Awareness | KnowBe4, SANS Institute | KnowBe4 provides engaging training modules that have shown to significantly improve employee awareness of privacy issues. SANS Institute is recognized for its comprehensive training programs that cater to various levels of expertise. |

Conclusion: Navigating the Privacy Software Landscape

In 2022, the market for data protection management software is characterized by high competition and a high degree of fragmentation, with a large number of companies, both large and small, competing for market share. The regional trends show an increasing importance of data protection and compliance, especially in North America and Europe, where the regulatory pressure is rising. Strategically, vendors should use advanced capabilities such as data analysis with machine learning, automation for streamlined processes, and sustainable business practices to meet evolving customer expectations. The flexibility of the products in terms of deployment and integration will also be crucial to maintain a competitive advantage. As the market evolves, decision-makers should pay attention to the above-mentioned key capabilities to identify potential leaders and adjust their strategies accordingly.

Leave a Comment