Rising Cybersecurity Threats

The increasing frequency and sophistication of cyber threats is a primary driver for the Preventive Risk Analytics Market. Organizations are compelled to adopt advanced analytics solutions to preemptively identify vulnerabilities and mitigate potential breaches. According to recent data, cybercrime is projected to cost businesses trillions annually, underscoring the necessity for robust preventive measures. As companies face escalating risks, the demand for analytics tools that can predict and prevent cyber incidents is likely to surge. This trend indicates a growing recognition of the importance of proactive risk management strategies, which are essential for safeguarding sensitive information and maintaining operational integrity.

Focus on Operational Efficiency

Operational efficiency remains a pivotal concern for organizations, propelling the Preventive Risk Analytics Market forward. Companies are increasingly seeking ways to streamline their operations while minimizing risks. Preventive risk analytics provides insights that help identify inefficiencies and potential threats, enabling organizations to optimize their processes. Data suggests that businesses that implement analytics-driven risk management strategies can achieve significant cost savings and improved performance. As the competitive landscape intensifies, the emphasis on operational efficiency will likely drive further investment in preventive risk analytics solutions, fostering a proactive approach to risk management.

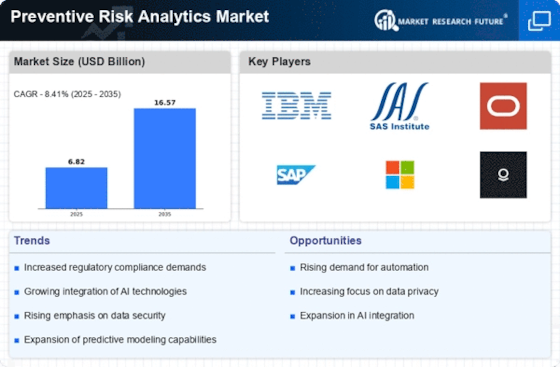

Growing Regulatory Requirements

The Preventive Risk Analytics Market is significantly influenced by the tightening of regulatory frameworks across various sectors. Organizations are increasingly required to comply with stringent regulations aimed at protecting consumer data and ensuring operational transparency. For instance, financial institutions must adhere to regulations that mandate risk assessments and reporting. This compliance landscape drives the demand for analytics solutions that can streamline risk management processes and ensure adherence to legal standards. As regulatory bodies continue to evolve their requirements, the market for preventive risk analytics is expected to expand, providing organizations with the tools necessary to navigate complex compliance challenges.

Demand for Enhanced Decision-Making

The need for improved decision-making processes is a crucial driver in the Preventive Risk Analytics Market. Organizations are recognizing that data-driven insights can significantly enhance their ability to anticipate and mitigate risks. By employing advanced analytics, businesses can make informed decisions that align with their risk appetite and strategic objectives. This trend is particularly evident in sectors such as finance and healthcare, where the stakes are high, and the cost of inaction can be substantial. As organizations strive for operational excellence, the demand for preventive risk analytics solutions that support strategic decision-making is likely to grow.

Increased Adoption of Cloud Technologies

The shift towards cloud computing is reshaping the Preventive Risk Analytics Market. Organizations are increasingly leveraging cloud-based analytics solutions to enhance their risk management capabilities. The flexibility and scalability offered by cloud technologies allow businesses to analyze vast amounts of data in real-time, facilitating quicker decision-making processes. Recent statistics indicate that the cloud services market is experiencing rapid growth, which correlates with the rising demand for preventive risk analytics. As more organizations migrate to the cloud, the integration of analytics tools that can proactively identify risks becomes essential, thereby driving market expansion.