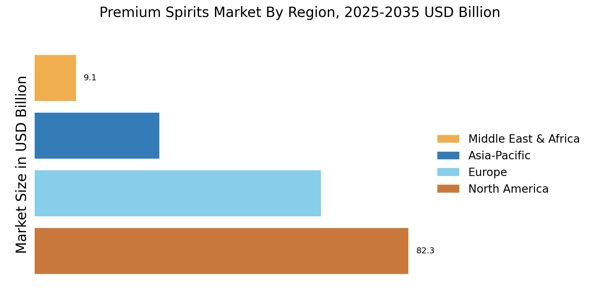

North America : Market Leader in Premium Spirits Market

North America is the largest market for premium spirits, accounting for approximately 45% of the global market share. The region's growth is driven by increasing disposable incomes, a growing trend towards premiumization, and a shift in consumer preferences towards high-quality alcoholic beverages. Regulatory support for craft distilleries and innovative marketing strategies further enhance market dynamics. The United States leads the North American market, with significant contributions from Canada. Key players such as Diageo, Brown-Forman, and Bacardi are well-established, driving competition and innovation. The presence of a diverse range of products, including whiskey, vodka, and rum, caters to varying consumer tastes, solidifying the region's position as a premium spirits powerhouse.

Europe : Emerging Trends in Spirits Consumption

Europe is witnessing a robust growth trajectory in the premium spirits market, holding approximately 35% of the global share. The region benefits from a rich heritage of distillation and a strong consumer base that values quality and craftsmanship. Regulatory frameworks supporting local distilleries and the rise of e-commerce are significant growth drivers. Countries like France and the UK are at the forefront, showcasing a blend of tradition and innovation. France, known for its cognac and whiskey, and the UK, with its gin and vodka, are leading markets. The competitive landscape features major players like Pernod Ricard and Moet Hennessy, who are continuously innovating to meet evolving consumer preferences. The increasing popularity of craft spirits and premium mixers is reshaping the market, making it a dynamic space for both established and emerging brands.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region is rapidly emerging as a significant player in the premium spirits market, accounting for about 15% of the global share. The growth is fueled by rising disposable incomes, urbanization, and a growing middle class that is increasingly inclined towards premium alcoholic beverages. Regulatory changes promoting local production and consumption are also contributing to market expansion. China and Japan are the leading countries in this region, with a strong demand for whiskey and sake, respectively. The competitive landscape is becoming more vibrant, with key players like Suntory Holdings and local distilleries gaining traction. The increasing trend of cocktail culture and premium mixers is further driving the market, making Asia-Pacific a focal point for premium spirits innovation.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa region is gradually emerging in the premium spirits market, holding around 5% of the global share. The growth is primarily driven by changing consumer attitudes towards alcohol consumption, urbanization, and a burgeoning tourism sector. Regulatory changes in several countries are also facilitating market entry for premium brands. South Africa and the UAE are the leading markets, showcasing a growing preference for premium wines and spirits. The competitive landscape is characterized by both international brands and local producers, with companies like Campari Group and William Grant & Sons making significant inroads. The region's unique cultural dynamics and increasing acceptance of premium products are paving the way for future growth in the spirits sector.