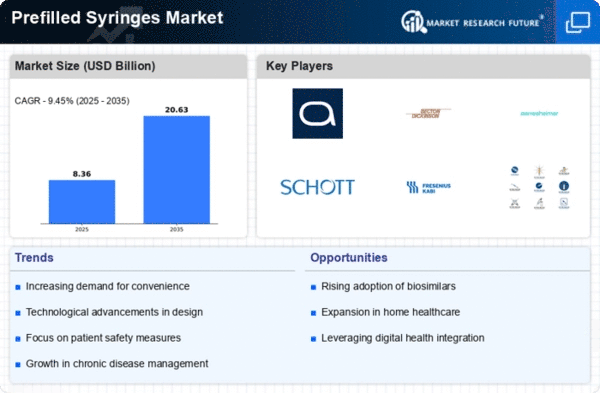

Market Growth Projections

The Global Prefilled Syringes Market Industry is poised for substantial growth, with projections indicating a market value of 5.06 USD Billion in 2024 and an anticipated increase to 9.5 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 5.89% from 2025 to 2035. Factors contributing to this expansion include the rising demand for self-administration, technological advancements, and the increasing prevalence of chronic diseases. The market's evolution reflects broader trends in healthcare, emphasizing the need for efficient and patient-friendly drug delivery systems.

Increase in Biologics and Biosimilars

The rise of biologics and biosimilars significantly influences the Global Prefilled Syringes Market Industry. As more biologic therapies are developed, the need for efficient delivery systems becomes paramount. Prefilled syringes offer a reliable method for administering these complex medications, ensuring accurate dosing and minimizing waste. The increasing approval of biosimilars is expected to further drive demand, as these products often utilize prefilled syringes for patient administration. This trend suggests a strong growth potential, with the market projected to expand at a CAGR of 5.89% from 2025 to 2035, reflecting the evolving landscape of the Global Prefilled Syringes Market Industry.

Rising Demand for Self-Administration

The Global Prefilled Syringes Market Industry experiences a notable increase in demand for self-administration devices. Patients prefer prefilled syringes due to their convenience and ease of use, particularly for chronic conditions requiring regular medication. This trend is supported by the growing prevalence of diseases such as diabetes and rheumatoid arthritis, which necessitate frequent injections. As a result, the market is projected to reach 5.06 USD Billion in 2024, indicating a robust growth trajectory. The self-administration trend not only enhances patient compliance but also reduces the burden on healthcare systems, thereby driving the expansion of the Global Prefilled Syringes Market Industry.

Regulatory Support and Standardization

Regulatory frameworks and standardization initiatives are pivotal in shaping the Global Prefilled Syringes Market Industry. Governments and health authorities are increasingly recognizing the importance of prefilled syringes in enhancing patient safety and treatment efficacy. Initiatives aimed at standardizing manufacturing processes and ensuring quality control are likely to bolster market confidence. For instance, guidelines from health organizations promote the use of prefilled syringes in vaccination campaigns, further driving their adoption. This regulatory support is expected to facilitate market growth, contributing to the anticipated increase in market value to 9.5 USD Billion by 2035.

Growing Focus on Patient-Centric Healthcare

The Global Prefilled Syringes Market Industry is witnessing a shift towards patient-centric healthcare models. This approach emphasizes the importance of patient experience and outcomes, leading to an increased preference for user-friendly drug delivery systems. Prefilled syringes align with this trend by offering ease of use and reducing the need for professional administration. As healthcare providers prioritize patient satisfaction, the demand for prefilled syringes is likely to rise. This shift may contribute to the overall growth of the market, with projections indicating a market value of 5.06 USD Billion in 2024, reflecting the changing dynamics of healthcare delivery.

Technological Advancements in Syringe Design

Technological innovations play a crucial role in shaping the Global Prefilled Syringes Market Industry. Enhanced designs, such as safety features and improved materials, contribute to better user experiences and reduced risks of needle-stick injuries. For instance, advancements in polymer technology have led to the development of syringes that are lighter and more durable. These innovations are likely to attract both manufacturers and healthcare providers, thereby expanding market opportunities. The ongoing investment in research and development suggests that the Global Prefilled Syringes Market Industry will continue to evolve, potentially reaching 9.5 USD Billion by 2035.