Rising Geriatric Population

The increasing geriatric population globally plays a crucial role in the expansion of the Global Dental Syringes Market Industry. Older adults often face various dental issues, necessitating more frequent dental visits and treatments. This demographic shift is prompting dental practitioners to invest in advanced syringes that facilitate effective treatment delivery. As the global population aged 65 and above continues to rise, the demand for dental syringes is likely to increase, thereby contributing to the overall market growth. This trend underscores the importance of adapting dental practices to meet the needs of an aging population.

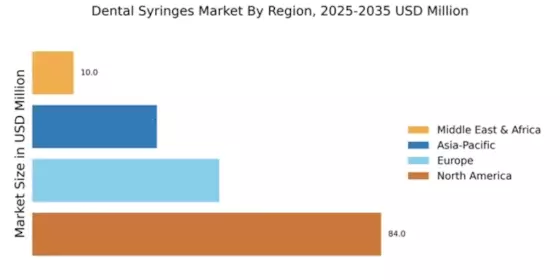

Market Trends and Projections

The Global Dental Syringes Market Industry is characterized by various trends and projections that indicate its future trajectory. The market is expected to grow from 2.13 USD Billion in 2024 to 3.5 USD Billion by 2035, reflecting a compound annual growth rate of 4.62% from 2025 to 2035. Factors such as technological advancements, increasing dental procedures, and a growing geriatric population are likely to drive this growth. Additionally, the focus on preventive care and regulatory support for innovations will further enhance the market landscape, making it a dynamic sector within the healthcare industry.

Growing Focus on Preventive Dental Care

The Global Dental Syringes Market Industry is positively influenced by the increasing emphasis on preventive dental care. As healthcare systems worldwide prioritize preventive measures, dental professionals are more inclined to utilize effective tools, including dental syringes, to administer treatments that prevent more severe dental issues. This proactive approach not only enhances patient outcomes but also reduces long-term healthcare costs. The market's growth is expected to be sustained as more dental practices adopt preventive strategies, further driving the demand for high-quality dental syringes.

Increasing Demand for Dental Procedures

The Global Dental Syringes Market Industry experiences a notable surge in demand due to the rising prevalence of dental disorders and the growing awareness of oral health. As more individuals seek dental treatments, the need for efficient and precise delivery systems, such as dental syringes, becomes paramount. In 2024, the market is projected to reach 2.13 USD Billion, reflecting a robust growth trajectory. This trend is likely to continue as dental professionals increasingly adopt advanced technologies to enhance patient care, thereby driving the demand for high-quality dental syringes.

Regulatory Support for Dental Innovations

Regulatory bodies worldwide are increasingly supporting innovations in dental care, which significantly impacts the Global Dental Syringes Market Industry. By establishing guidelines and standards for the development and use of dental syringes, these organizations foster an environment conducive to technological advancements. This regulatory support encourages manufacturers to invest in research and development, leading to the introduction of safer and more efficient syringes. As a result, the market is projected to grow at a CAGR of 4.62% from 2025 to 2035, reflecting the positive influence of regulatory frameworks on industry growth.

Technological Advancements in Syringe Design

Innovations in the design and functionality of dental syringes significantly contribute to the growth of the Global Dental Syringes Market Industry. Recent advancements include the development of safety-engineered syringes and electronic dispensing systems that improve accuracy and reduce the risk of needlestick injuries. These technological enhancements not only increase the efficiency of dental procedures but also align with regulatory standards aimed at ensuring patient safety. As a result, the market is expected to expand, with projections indicating a growth to 3.5 USD Billion by 2035, driven by these innovations.