Increasing Regulatory Standards

The Precipitated Silica Market is also shaped by the rising regulatory standards concerning product safety and environmental impact. Governments and regulatory bodies are implementing stricter guidelines for the use of additives in various industries, including food, cosmetics, and automotive. Compliance with these regulations is essential for manufacturers, prompting them to seek high-quality precipitated silica that meets safety and performance criteria. This trend is likely to drive innovation and investment in the Precipitated Silica Market, as companies strive to enhance their product offerings while adhering to regulatory requirements. The emphasis on safety and sustainability may lead to a more competitive landscape, ultimately benefiting consumers and the industry as a whole.

Rising Demand in Automotive Sector

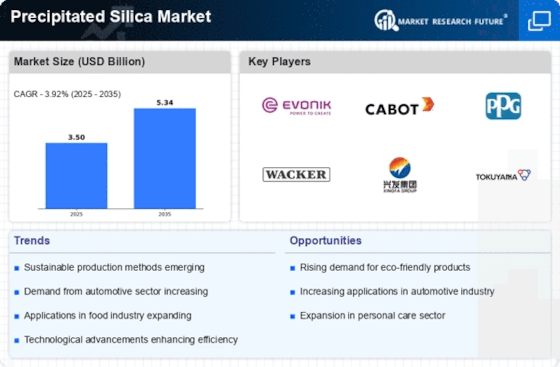

The Precipitated Silica Market is experiencing a notable surge in demand from the automotive sector. This increase is primarily driven by the growing need for lightweight materials that enhance fuel efficiency and reduce emissions. Precipitated silica is utilized in tire manufacturing, where it improves wet traction and rolling resistance. According to recent estimates, the automotive industry accounts for a substantial share of the precipitated silica consumption, with projections indicating a compound annual growth rate of approximately 5% over the next few years. As automotive manufacturers continue to prioritize sustainability and performance, the demand for precipitated silica is likely to rise, further solidifying its role in the Precipitated Silica Market.

Expansion in Personal Care Products

The Precipitated Silica Market is witnessing significant growth due to its increasing application in personal care products. Silica is widely used as a thickening agent, anti-caking agent, and absorbent in cosmetics and skincare formulations. The rising consumer awareness regarding personal grooming and hygiene is propelling the demand for high-quality personal care products, which in turn drives the need for precipitated silica. Market data suggests that the personal care segment is expected to grow at a rate of around 4% annually, reflecting the industry's shift towards innovative and effective formulations. This trend indicates a promising future for the Precipitated Silica Market as manufacturers seek to enhance product performance and consumer satisfaction.

Growth in Food and Beverage Applications

The Precipitated Silica Market is benefiting from its expanding use in the food and beverage sector. Silica serves as an anti-caking agent and a flow agent in powdered food products, ensuring consistency and quality. The increasing demand for processed and packaged foods is driving the need for effective additives, including precipitated silica. Recent market analysis indicates that the food and beverage segment is projected to grow at a rate of approximately 3.5% per year, highlighting the potential for precipitated silica to play a crucial role in maintaining product integrity. As consumer preferences shift towards convenience and quality, the Precipitated Silica Market is likely to see sustained growth in this application area.

Technological Innovations in Manufacturing

Technological advancements in the manufacturing processes of precipitated silica are significantly influencing the Precipitated Silica Market. Innovations such as improved precipitation techniques and enhanced purification methods are leading to higher quality products with better performance characteristics. These advancements not only increase production efficiency but also reduce environmental impact, aligning with the industry's sustainability goals. As manufacturers adopt these technologies, the overall supply chain becomes more robust, potentially lowering costs and increasing accessibility. The ongoing research and development efforts in this field suggest that the Precipitated Silica Market will continue to evolve, driven by the need for superior products and sustainable practices.