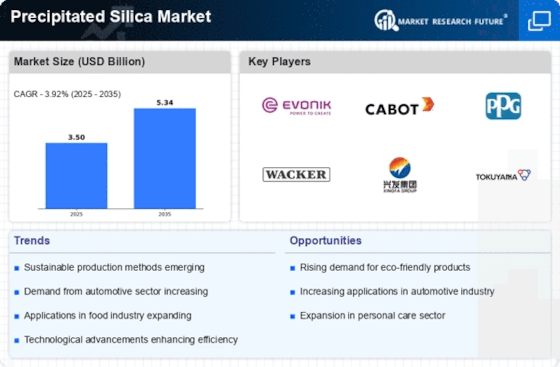

Top Industry Leaders in the Precipitated Silica Market

The global precipitated silica market is poised for steady growth, driven by its versatile applications across diverse industries like rubber, food, cosmetics, and pharmaceuticals. This growth, however, unfolds within a complex competitive landscape, where established players jostle with new entrants vying for market share.

Market Share and Strategies:

The market landscape is fragmented, with major players holding substantial shares but no single entity dominating. Key players include Evonik Industries AG, PPG Industries Inc., Solvay SA, W.R. Grace & Co., Huber Engineered Materials, and Oriental Silica Corporation. These companies compete fiercely through various strategies, including:

- Product differentiation: Developing specialized silica grades tailored to specific applications, offering high purity and customized functionalities.

- Geographical expansion: Investing in production facilities in emerging markets with high growth potential, like Asia-Pacific and Latin America.

- Vertical integration: Expanding into upstream and downstream segments of the supply chain to secure raw materials and distribution channels.

- Technological innovation: Continuous R&D to improve production efficiency, develop new applications, and enhance product performance.

- Sustainability focus: Implementing eco-friendly production processes and offering sustainable silica grades to cater to growing consumer and regulatory demands.

Market Share Drivers:

Factors influencing market share are:

- Product type: Different grades of silica cater to diverse applications, with each type driving growth in specific segments. For example, food-grade silica for anticaking agents holds a significant share, while the market for high-dispersity silica for tire production is also booming.

- Regional dynamics: Asia-Pacific, with its vast population and rapid industrialization, is the fastest-growing market, while established regions like North America and Europe hold a larger share.

- End-use industry trends: Rising demand in industries like food & beverage, cosmetics, and pharmaceuticals directly influences the consumption of specific silica grades.

- Price and cost competitiveness: Efficient production processes, access to raw materials, and economies of scale play a crucial role in determining price competitiveness.

List of Key Players in the Precipitated Silica Market

PPG Industries, Inc. (the US)

Industrias Químicas del Ebro, SA ( Spain)

Evonik Industries AG (Germany)

Tata Chemicals Ltd (India)

AntenChem Co., Ltd

Solvay SA (Belgium)

PQ Corporation (US)

W.R. Grace & Co. (US)

Oriental Silica Corporation (Taiwan)

Tosoh Silica Corporation (Japan)

Huber Engineered Materials (US)

Supersil Chemicals (I) Pvt. Ltd (India)

Madhu Silica Pvt. Ltd (India)

Gujarat Multi Gas Base Chemicals Pvt. Ltd (India)

Wacker Chemie AG (Germany)

Recent Developments:

September 2023: W.R. Grace launches its new line of SYLOID® silica products specifically designed for lithium-ion battery electrodes, capitalizing on the booming electric vehicle market.

October 2023: Evonik inks a joint venture agreement with a Chinese company to build a new precipitated silica plant in Shandong province, further solidifying its presence in the Chinese market.

November 2023: The International Silica Industry Conference (ISIC) in New Orleans highlights the industry's focus on sustainability and innovation, with presentations on bio-based silica and renewable energy applications.

December 2023: PPG Industries reports a surge in demand for its high-performance precipitated silica grades used in tire manufacturing, driven by increasing fuel efficiency regulations.