Market Trends

Key Emerging Trends in the Pre Workout Supplements Market

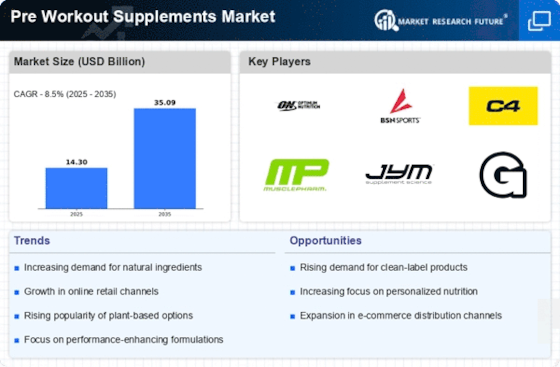

In recent years, there has been a surge in demand for fitness-related products, leading to significant growth and transformation in the Pre-Workout Supplements niche. With multinational companies beginning to enter into this industry, there is an expected increase in demand for these supplements. This rising demand meekly correlates with an increased acknowledgment of the importance of using such supplements for exercise purposes by people across various age groups from all walks of life. Given that these multinationals strategically position themselves across this region, it means that customers have access to an assortment, which leads to competition as well as innovation. China particularly reflects this trend since its vibrant performance demonstrates that health consciousness is currently winning among its citizens. India's rapidly growing market is attributed largely to escalating interest in fitness & wellness coupled with extensive awareness regarding the benefits of pre-exercise supplementations. One notable trend among consumers of such dietary guidelines includes clean-label ingredients featuring natural aspects. To illustrate, when buyers turn out as more health-conscious individuals seeking transparency in products, they choose natural ingredients in a bid to get ready for workouts. Another trend that has shaped the market is the rise of personalized and functional formulations. Consumers are increasingly seeking pre-workout supplements tailored to their fitness objectives and individual requirements. As a result, there have been products with targeted formulas that focus on energy boost, endurance building, muscular recovery, and brain performance. Additionally, the Pre-Workout Supplements market is seeing increased traction towards ready-to-drink (RTD) and convenient formats. Demand for pre-packaged offerings that can be easily consumed has escalated due to busy schedules and on-the-go exercise programs. The market has shifted to digital marketing as well as e-commerce platforms. With reliance on online platforms for both shopping and information-seeking purposes gone up significantly, digital marketing techniques have become effective tools through which pre-workout supplement brands communicate to their target customers, who are mostly distributed across different geographical areas around the world. Additionally, cognitive-enhancing components in these nutritional requirements are becoming more important because users now know how much they need healthy minds during exercise. Some such supplements contain nootropics, which help them feel sharper mentally.

Leave a Comment