Market Share

Pre Workout Supplements Market Share Analysis

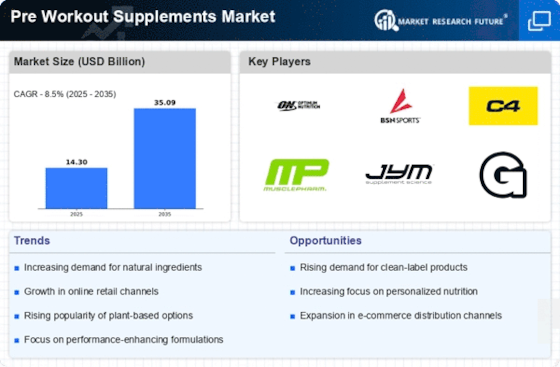

The Pre-Workout Supplements Market has seen tremendous growth recently, forcing brands to adopt diverse market share positioning strategies that can separate them from the rest. One of these is formulation innovation for differentiation purposes. Brands are investing in research and development to produce unique pre-workout formulations since fitness enthusiasts are after impactful and science-backed supplements. In 2022, the Pre-Workout Supplements market showed strong growth, capturing a notable market share, especially in Europe, which was accelerated by a huge demand for pre-workout supplements coupled with a significant number of health-conscious consumers within the region. Notably, the European market registered a massive increase in revenue due to the popularity of pre-workout supplements and widespread adoption of preworkouts, among other factors. An unprecedented request for these supplements triggered by increasing consumers' interest in fitness and wellness has led to an unprecedented surge in demand for those products, indicating a paradigm shift towards prevention health care management. The trend highlights how customer preferences drive market moves. Among the health-conscious European segment, there are signs that this region could become the epicenter of activity in the Pre-Workout Supplements market for possible economic windfalls. Pricing strategies are important determinants of market share within the Pre-Workout Supplements Market. Competitive pricing enables companies to attract cost-conscious customers, hence increasing their market coverage. Alternatively, premium brands can opt for higher prices, positioning themselves as suppliers of high-quality and top-of-the-range supplements for individuals who are ready to spend on their fitness journey. Distribution channels play an important role in reaching out to a wider consumer base and maintaining or even expanding one's market. Strategic collaboration with gyms, fitness centers, and online retailers helps brands make sure that their products will always be available for sports persons. Brand positioning is a vital element in market share strategies within the Pre-Workout Supplements Market. Building up a strong brand identity helps foster trust amongst consumers. Additionally, product format innovations are essential drivers of pre-workout sales growth, which results in gaining a bigger part of shares in terms of volume or value by a certain company among direct competitors. In order to serve varying tastes and lifestyles among consumers, brands offer different product formats such as powders, ready-to-drink beverages, or capsules throughout diversified consumers' choices. The most effective method of convincing any individual consumer to buy your product over your competitors is through marketing communication skills that strategically place your brand directly on top of competitors within its niche, thus enabling it to sell faster than other similar goods in the same shop shelf. They also contribute significantly to achieving high levels of brand awareness by providing endorsements and partnerships with key fitness stakeholders.

Leave a Comment