April 2024

Black Bay Energy Capital (“Black Bay”) portfolio firm Advanced Industrial Devices (“AID”) is pleased to announce the purchase of R.S. Integrators, Inc. (“RSI”). RSI, based in Pineville, North Carolina, develops and produces electric motor control systems and power distribution panels for water, wastewater, and other industries. This strategic purchase of RSI is a milestone for AID's fast development in these end-markets and establishes a bellwether brand with unrivaled product quality and customer service.

The combined organisation will capitalise on industrial electrification by providing end-users with world-class excellence, technical expertise, high-quality customer service, and a geographic footprint to achieve business efficiency, sustainability, and decarbonisation goals.

AID CEO Russell Claybrook said the purchase was strategic: “The RSI team has built an impressive brand in the water utilities and power distribution markets and boasts design and engineering capabilities that perfectly complement our own. In 2021, AID strategically expanded into industrial dewatering and water utilities, which has grown our company. AID is thrilled to combine RSI's skills with our products to continue offering fit-for-purpose motor control solutions and market-leading customer service.”

Ron Sigmon said, “I am extremely proud of the company we have built at RSI and the strong brand value we have created in our end markets. The AID and RSI organizations share key beliefs and a passion for specialized application solutions. Sigmon said, “I want to thank our RSI employees for their hard work and immense contributions to get us to this point, and I am excited to deliver enhanced solutions to our loyal customer base, as well as new customer relationships under the combined organization.”

AID's southeast US expertise and market position in industrial dewatering and water utilities have grown with the purchase of RSI. To further service these end-markets, AID established its world-class UL508A and UL698 industrial controls and motor controls production and training facilities in Fort Mill, SC in April 2023.

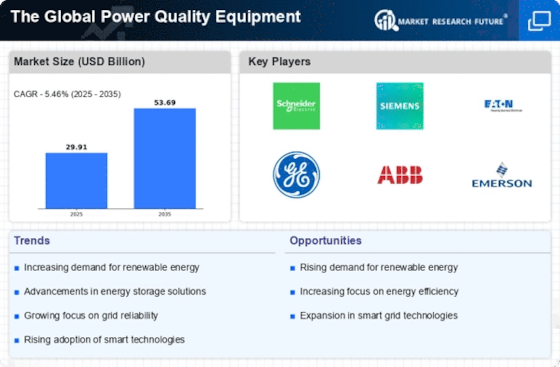

May 2022: To ensure grid stability at three substations in South-West Ireland, ESB awarded Siemens Energy three contracts to provide its Static Compensator technology (SVC Plus).

March 2022: The Schaffner group introduced passive harmonic filters in the Ecosine Max series. The IEEE-519 and other international power quality standards are complied with by these harmonic filters.

June 2021: Eaton successfully acquired 50% of the Chinese Busway business of Jiangsu YiNeng Electric. With the help of this deal, Eaton will be able to diversify its power distribution offerings in the APAC market.

May 2021: The SmartPDU power distribution system was introduced by Acumentrics. It provides an unprecedented level of comfort, flexibility, secure control, and system data, ensuring the best possible performance of onboard electronic equipment while making possible adjustments and upgrades.