Top Industry Leaders in the Power Quality Equipment Market

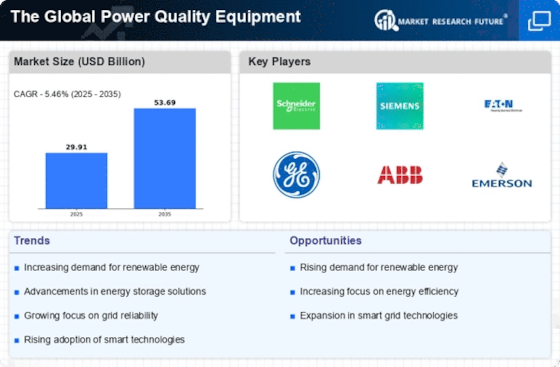

The power quality equipment market, expected to experience significant growth, is marked by intense competition. Well-established players contend with agile emerging contenders, all striving for dominance in this rapidly evolving arena. Grasping the strategic intricacies of this landscape is essential for successfully navigating the complex path to success.

Key Players & Their Approaches:

- ABB Ltd. (Switzerland)

- General Electric Company (US)

- Schneider Electric (France)

- Siemens AG (Germany)

- Emerson Electric Company (US)

- Eaton Corporation Plc (Ireland)

- Active Power Inc. (US)

- MTE Corporation (US)

- Smiths Group plc. (UK)

- Toshiba Corporation (Japan), and others.

- Global Industry Leaders: Eaton Corporation, Schneider Electric, and Siemens AG hold top positions, leveraging their extensive portfolios, robust service networks, and brand recognition. For example, Eaton focuses on digitalization with its PowerWise line, while Schneider Electric champions smart grid solutions.

- Regional Dominators: Companies like Socomec (France) and Legrand (France) excel in specific segments, establishing strong regional footholds. Socomec's expertise in harmonic mitigation is well-received in Europe, and Legrand capitalizes on established distribution channels in developing markets.

- Emerging Disruptive Forces: Acumentrics, with its innovative SmartPDU power distribution systems, and Active Power, a leader in power factor correction solutions, embody the disruptive spirit of new entrants. Their agility and focus on niche technologies enable them to challenge the market share of established players.

Market Share Analysis: Balancing Scale & Agility: While market share remains a critical metric, interpreting it requires nuance. Established players, with their vast portfolios, naturally command larger shares. However, their sheer size can sometimes impede agility, creating opportunities for smaller, more nimble competitors. Companies like Active Power, concentrating on specific segments with cutting-edge solutions, can outmaneuver larger players within that domain.

Emerging Trends Shaping the Industry: • Integration & Intelligence: The convergence of power quality equipment with IoT and AI is transformative. Smart UPS systems, predictive maintenance algorithms, and cloud-based monitoring platforms are reshaping the market. Schneider Electric's EcoStruxure, for instance, provides a comprehensive smart grid management solution.

- Sustainability & Renewables: The ascent of renewable energy sources like solar and wind introduces unique power quality challenges. Companies like Eaton, with expertise in grid protection and energy storage solutions, are well-positioned to benefit from this trend.

- Regional Dynamics: Market growth varies across regions. Asia-Pacific, fueled by rapid industrialization and infrastructure development, serves as a key growth engine. Europe, with its focus on grid modernization and renewable energy integration, presents another promising landscape. Understanding regional specifics is crucial for tailoring strategies.

Competitive Scenario: Collaboration & Competition Coexist: Despite the competitive landscape, collaboration is emerging as a key theme. Strategic partnerships between players leverage complementary strengths and expand market reach. For example, Eaton and Socomec have collaborated on harmonic mitigation solutions.

However, at the core, the market remains fiercely competitive. Players continually innovate, optimize pricing strategies, and refine distribution channels to gain a competitive edge. Staying abreast of these ever-shifting dynamics is essential for success.

The power quality equipment market forms a vibrant tapestry woven with established giants, regional powerhouses, and disruptive newcomers. Understanding strategies, market share nuances, emerging trends, and regional dynamics is vital for navigating this competitive landscape. Companies that adapt to changing currents, innovate relentlessly, and forge strategic partnerships will be well-positioned to capture the immense potential of this dynamic market.

Industry Developments and Latest Updates:

ABB Ltd. (Switzerland): • Dec 15, 2023: ABB unveils PowerShield Harmony X, a cloud-based power quality monitoring and analytics platform aimed at improving grid resilience and reliability. (Source: ABB press release) • Nov 07, 2023: ABB and Shell partner to deliver integrated microgrid solutions for remote and off-grid applications. (Source: Shell website)

General Electric Company (US): • Dec 12, 2023: GE Grid Solutions announces the launch of its GridStat Connect energy storage solution, designed for flexible grid management. (Source: GE Grid Solutions website) • Oct 26, 2023: GE Renewable Energy secures a contract to supply wind turbines and grid integration solutions for a 1.2 GW wind farm in India. (Source: GE Renewable Energy website)

Schneider Electric (France): • Dec 19, 2023: Schneider Electric introduces EcoStruxure Power Monitoring Expert 3.0, an updated software suite for comprehensive power quality management. (Source: Schneider Electric website) • Nov 29, 2023: Schneider Electric acquires Bangalore-based industrial automation company L&T Technology Services to strengthen its presence in India's growing automation market. (Source: Schneider Electric press release)

Siemens AG (Germany): • Dec 05, 2023: Siemens Smart Infrastructure unveils its SIVACORN 3RM7 series of active harmonic filters for industrial applications. (Source: Siemens Smart Infrastructure website) • Oct 24, 2023: Siemens Energy partners with Ørsted to develop a large-scale offshore wind farm with integrated hydrogen production in Germany. (Source: Siemens Energy website)

Emerson Electric Company (US): • Dec 07, 2023: Emerson launches its Sure✞Flow™ smart valve controller for enhanced flow control and energy efficiency in industrial processes. (Source: Emerson website) • Sep 20, 2023: Emerson acquires Aspen Technology, a leading provider of industrial software solutions, to expand its digital offerings in the power and water industries. (Source: Emerson press release)