Surge in Electric Vehicle Adoption

The surge in electric vehicle (EV) adoption is a pivotal driver for the Power Management IC Market's Market. As consumers increasingly shift towards sustainable transportation options, the demand for efficient power management solutions in EVs has escalated. Power Management ICs play a critical role in managing battery performance, optimizing energy consumption, and enhancing overall vehicle efficiency. The electric vehicle market is projected to grow exponentially, with millions of units expected to be sold annually in the near future. This growth necessitates the development of advanced Power Management ICs that can support the unique power requirements of electric vehicles. Consequently, manufacturers are focusing on innovation to create ICs that enhance the performance and reliability of EVs, thereby propelling the growth of the Power Management IC Market's Market.

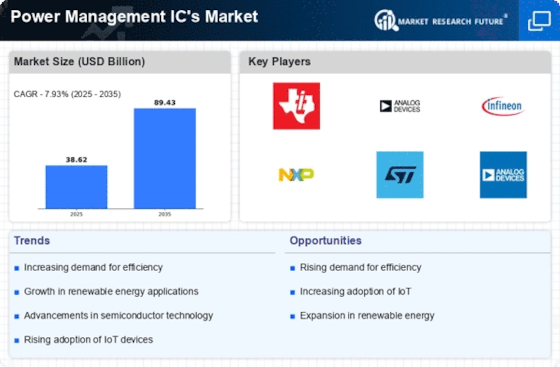

Rising Demand for Energy Efficiency

The increasing emphasis on energy efficiency across various sectors is a primary driver for the Power Management IC Market's Market. As industries strive to reduce energy consumption and lower operational costs, the demand for advanced power management solutions has surged. According to recent data, the energy efficiency market is projected to grow significantly, with power management solutions playing a crucial role in achieving these goals. This trend is particularly evident in sectors such as consumer electronics, automotive, and industrial applications, where energy-efficient designs are becoming a standard requirement. Consequently, manufacturers are focusing on developing innovative Power Management ICs that not only enhance performance but also contribute to sustainability efforts. This shift towards energy efficiency is likely to propel the growth of the Power Management IC Market's Market in the coming years.

Growth of the Internet of Things (IoT)

The proliferation of the Internet of Things (IoT) is significantly influencing the Power Management IC Market's Market. As more devices become interconnected, the need for efficient power management solutions has become paramount. IoT devices often require low power consumption to extend battery life and ensure optimal performance. The market for IoT is expected to expand rapidly, with billions of devices anticipated to be connected in the near future. This surge in IoT applications necessitates the development of specialized Power Management ICs that can handle diverse power requirements while maintaining efficiency. Manufacturers are increasingly investing in research and development to create ICs that cater to the unique needs of IoT devices, thereby driving growth in the Power Management IC Market's Market.

Increasing Focus on Renewable Energy Integration

The increasing focus on renewable energy integration is a significant driver for the Power Management IC Market's Market. As nations strive to transition towards sustainable energy sources, the demand for efficient power management solutions to integrate renewable energy systems has intensified. Power Management ICs are essential for optimizing the performance of solar panels, wind turbines, and other renewable energy technologies. The market for renewable energy is expected to expand rapidly, with investments in clean energy solutions projected to reach substantial levels. This trend creates opportunities for Power Management IC Market manufacturers to develop innovative solutions that enhance the efficiency and reliability of renewable energy systems. As a result, the Power Management IC Market's Market is likely to experience robust growth in response to the increasing emphasis on renewable energy integration.

Advancements in Telecommunications Infrastructure

The ongoing advancements in telecommunications infrastructure are a significant driver for the Power Management IC Market's Market. With the rollout of 5G technology, there is a heightened demand for efficient power management solutions to support the increased data transmission rates and connectivity requirements. Telecommunications equipment, including base stations and routers, requires robust power management to ensure reliability and performance. The market for telecommunications infrastructure is projected to witness substantial growth, with investments in 5G networks expected to reach unprecedented levels. This creates a favorable environment for Power Management IC Market manufacturers to innovate and provide solutions that meet the stringent power requirements of next-generation telecommunications systems. As a result, the Power Management IC Market's Market is likely to benefit from these advancements.