Rising Demand for Consumer Electronics

The power management-IC market in South Korea is experiencing a notable surge in demand driven by the increasing consumption of consumer electronics. With the proliferation of smartphones, tablets, and wearable devices, manufacturers are seeking efficient power management solutions to enhance battery life and performance. In 2025, the consumer electronics sector is projected to grow by approximately 8%, further propelling the need for advanced power management-ic technologies. This trend indicates a shift towards more compact and energy-efficient designs, compelling companies to innovate and invest in power management-ic solutions that cater to the evolving needs of consumers. As a result, the power management-ic market is likely to witness substantial growth, reflecting the dynamic nature of consumer preferences and technological advancements.

Growing Demand for Smart Home Solutions

The power management-IC market is experiencing growth. This growth is due to the rising demand for smart home solutions in South Korea. As consumers increasingly adopt smart devices for home automation, the need for efficient power management becomes paramount. In 2025, the smart home market is projected to expand by 25%, driving the demand for power management-ic technologies that can optimize energy consumption and enhance device interoperability. This trend indicates a shift towards integrated systems that require advanced power management solutions to ensure seamless operation. Consequently, the power management-ic market is likely to thrive as manufacturers respond to the evolving landscape of smart home technologies, focusing on energy efficiency and user convenience.

Increased Focus on Renewable Energy Sources

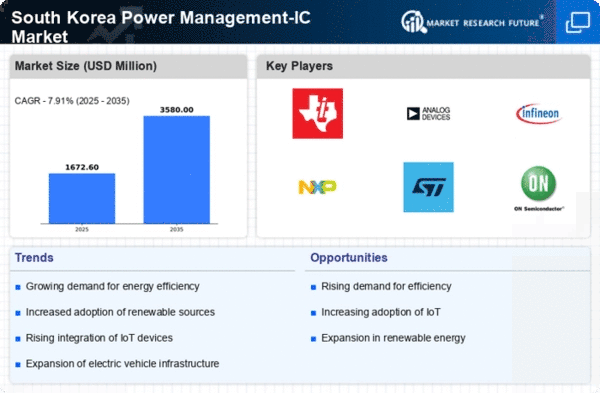

The power management-ic market in South Korea is witnessing a transformation due to the increased focus on renewable energy sources. As the country aims to diversify its energy portfolio, the integration of solar and wind energy systems is becoming more prevalent. This shift necessitates the development of sophisticated power management-ic solutions that can efficiently manage energy flow and storage. In 2025, renewable energy is projected to account for approximately 20% of the total energy mix, creating a demand for ICs that can facilitate the transition to sustainable energy systems. The power management-ic market is likely to benefit from this trend, as companies invest in technologies that enhance the efficiency and reliability of renewable energy applications.

Expansion of Electric Vehicle Infrastructure

The power management-IC market is significantly influenced by the expansion of electric vehicle (EV) infrastructure in South Korea. The government promotes the adoption of EVs to reduce carbon emissions. As the government promotes the adoption of EVs to reduce carbon emissions, the demand for efficient power management solutions becomes critical. In 2025, the number of EV charging stations is expected to increase by over 30%, necessitating advanced power management-ic systems to optimize energy distribution and charging efficiency. This growth not only supports the automotive sector but also stimulates innovation in power management technologies, as manufacturers strive to develop ICs that can handle the unique challenges posed by EV applications. Consequently, the power management-ic market is poised for growth, driven by the intersection of automotive advancements and energy management needs.

Technological Advancements in Semiconductor Manufacturing

Technological advancements in semiconductor manufacturing are playing a pivotal role in shaping the power management-ic market. In South Korea, the semiconductor industry is renowned for its innovation and efficiency, which directly impacts the development of power management solutions. As manufacturing processes evolve, the production of smaller, more efficient ICs becomes feasible, allowing for enhanced performance in various applications. By 2025, the market for advanced semiconductor technologies is expected to grow by 15%, indicating a robust environment for power management-ic innovations. This growth suggests that manufacturers are likely to leverage cutting-edge technologies to create ICs that meet the increasing demands for energy efficiency and compact design in consumer and industrial applications.