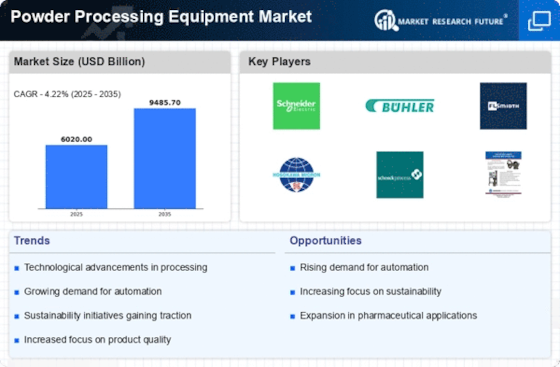

Growing Focus on Sustainability

Sustainability is becoming a pivotal driver in the Powder Processing Equipment Market. Manufacturers are increasingly adopting eco-friendly practices and technologies to minimize their environmental impact. This includes the use of energy-efficient equipment and processes that reduce waste generation. The market for sustainable powder processing solutions is projected to grow at a compound annual growth rate of 5.2% over the next five years. Companies are also exploring biodegradable materials and sustainable sourcing of raw materials, which aligns with consumer preferences for environmentally responsible products. This shift towards sustainability is likely to create new opportunities within the powder processing equipment sector.

Expansion of the Chemical Industry

The Powder Processing Equipment Market is benefiting from the expansion of the chemical industry, which is a major consumer of powder processing technologies. As the chemical sector continues to grow, driven by increasing industrial applications and innovations, the demand for efficient powder processing equipment is expected to rise. The Powder Processing Equipment Market is projected to reach USD 5 trillion by 2027, indicating a robust growth potential. This expansion necessitates advanced processing solutions to handle various powders, including catalysts, pigments, and specialty chemicals. Consequently, the powder processing equipment market is likely to see increased investments and innovations to meet these demands.

Emergence of New Applications and Markets

The Powder Processing Equipment Market is witnessing the emergence of new applications and markets, which is driving growth. Industries such as cosmetics, electronics, and additive manufacturing are increasingly utilizing powder processing technologies for their unique requirements. For example, the rise of 3D printing has created a demand for specialized powder materials and processing equipment. The cosmetics industry is also exploring innovative powder formulations for beauty products. This diversification into new sectors is expected to broaden the market landscape, providing opportunities for manufacturers to develop tailored solutions that cater to specific industry needs, thereby enhancing the overall growth of the powder processing equipment market.

Rising Demand from Pharmaceutical and Food Industries

The Powder Processing Equipment Market is significantly driven by the increasing demand from the pharmaceutical and food sectors. These industries require precise and efficient powder processing solutions to ensure product quality and compliance with stringent regulations. The pharmaceutical sector, in particular, is projected to witness substantial growth, with a market size expected to reach USD 1.5 billion by 2026. This growth is attributed to the rising need for powdered formulations and the development of new drugs. Similarly, the food industry is focusing on enhancing product consistency and safety, further propelling the demand for advanced powder processing equipment.

Technological Advancements in Powder Processing Equipment

The Powder Processing Equipment Market is experiencing a surge in technological advancements that enhance efficiency and precision in powder handling. Innovations such as advanced milling techniques, improved mixing technologies, and automated systems are becoming increasingly prevalent. These advancements not only streamline production processes but also reduce operational costs. For instance, the integration of Industry 4.0 technologies allows for real-time monitoring and control, which can lead to a reduction in waste and improved product quality. As manufacturers seek to optimize their operations, the demand for state-of-the-art powder processing equipment is likely to rise, indicating a robust growth trajectory for the industry.