Increasing E-commerce Activities

The rise of e-commerce has a profound impact on the Postal Automation System Market. With online shopping becoming a preferred choice for consumers, postal services are witnessing an unprecedented increase in parcel volumes. Reports indicate that e-commerce sales have surged, leading to a corresponding demand for efficient postal solutions. As a result, postal operators are investing heavily in automation systems to handle the influx of packages. This shift is not merely a response to current trends; it is a strategic move to enhance operational capabilities and customer satisfaction. The ability to process and deliver parcels swiftly is crucial for maintaining competitiveness in an increasingly digital marketplace.

Technological Advancements in Automation

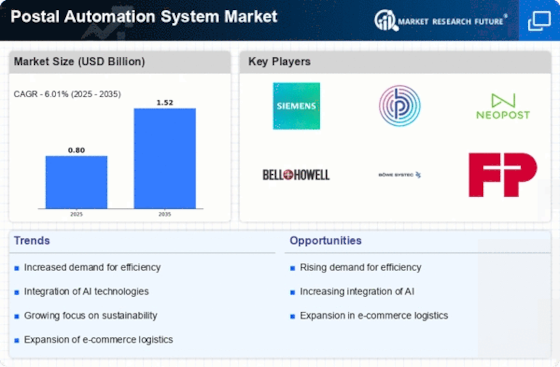

The Postal Automation System Market is experiencing a surge in technological advancements, particularly in automation technologies. Innovations such as robotics, artificial intelligence, and machine learning are being integrated into postal systems, enhancing efficiency and accuracy. For instance, automated sorting systems can process thousands of packages per hour, significantly reducing manual labor and operational costs. The adoption of these technologies is projected to increase productivity by up to 30%, thereby transforming traditional postal operations. As postal services strive to meet the growing demands of consumers, the implementation of advanced automation solutions becomes imperative. This trend not only streamlines operations but also improves service delivery, positioning companies favorably in a competitive landscape.

Demand for Enhanced Operational Efficiency

In the Postal Automation System Market, there is a growing demand for enhanced operational efficiency. Organizations are under pressure to optimize their processes to reduce costs and improve service delivery. Automation systems play a pivotal role in achieving these objectives by minimizing human error and expediting sorting and delivery times. Studies suggest that companies implementing automated solutions can achieve cost reductions of up to 25%. This drive for efficiency is not only about cutting costs; it is also about improving the overall customer experience. As postal services seek to adapt to changing consumer expectations, the integration of automation technologies becomes a strategic necessity.

Regulatory Compliance and Security Enhancements

The Postal Automation System Market is increasingly influenced by regulatory compliance and security requirements. Governments and regulatory bodies are imposing stricter guidelines to ensure the safe and secure handling of mail and packages. Automation systems are being developed to meet these compliance standards, incorporating advanced security features such as tracking and monitoring capabilities. This focus on security is essential for maintaining consumer trust and safeguarding sensitive information. As postal services navigate these regulatory landscapes, the integration of automated solutions not only aids in compliance but also enhances operational transparency. This dual benefit positions companies to better serve their customers while adhering to legal obligations.

Sustainability Initiatives in Postal Operations

Sustainability is becoming a central theme in the Postal Automation System Market. As environmental concerns grow, postal services are increasingly adopting sustainable practices to reduce their carbon footprint. Automation systems contribute to these initiatives by optimizing routes and reducing energy consumption. For example, automated sorting facilities can minimize waste and enhance resource efficiency. The shift towards sustainability is not merely a trend; it is becoming a fundamental aspect of corporate responsibility. Companies that prioritize eco-friendly practices are likely to gain a competitive edge, appealing to environmentally conscious consumers. This alignment with sustainability goals is essential for the long-term viability of postal operations.