Market Growth Projections

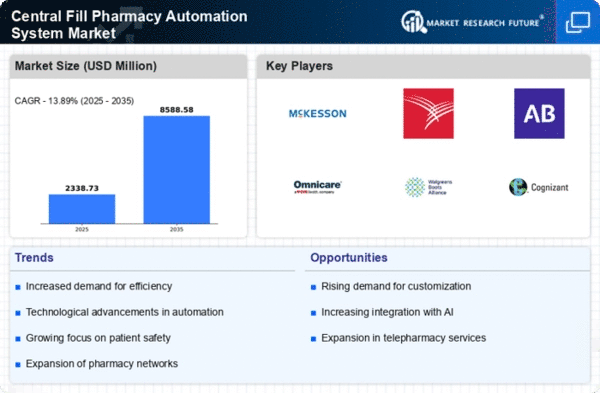

The Global Central Fill Pharmacy Automation System Market Industry is poised for substantial growth, with projections indicating an increase from 2.05 USD Billion in 2024 to 8.59 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 13.91% from 2025 to 2035. Such figures reflect the increasing adoption of automation technologies in pharmacies, driven by the need for enhanced efficiency, accuracy, and patient safety. The market's expansion is likely to attract investments and innovations, further solidifying its position within the healthcare landscape.

Growing Focus on Patient Safety

The growing focus on patient safety is a significant driver in the Global Central Fill Pharmacy Automation System Market Industry. As healthcare systems worldwide prioritize patient outcomes, the adoption of automated pharmacy systems is seen as a means to enhance safety and reduce medication errors. This trend is underscored by the projected market growth from 2.05 USD Billion in 2024 to 8.59 USD Billion by 2035, indicating a robust CAGR of 13.91% from 2025 to 2035. By improving accuracy and efficiency in medication dispensing, these systems contribute to better health outcomes and patient satisfaction.

Regulatory Support and Compliance

Regulatory support is increasingly influencing the Global Central Fill Pharmacy Automation System Market Industry. Governments and health authorities are establishing guidelines that encourage the adoption of automated systems to ensure compliance with safety standards. This regulatory backing not only promotes the use of advanced technologies but also instills confidence among healthcare providers regarding the efficacy of these systems. As the market continues to expand, the alignment of automation systems with regulatory requirements will likely drive growth, contributing to the anticipated rise from 2.05 USD Billion in 2024 to 8.59 USD Billion by 2035.

Rising Demand for Prescription Accuracy

The Global Central Fill Pharmacy Automation System Market Industry experiences a notable increase in demand for prescription accuracy. As medication errors can lead to severe health complications, healthcare providers are increasingly adopting automation systems to enhance precision in dispensing. This trend is further supported by the projected market growth from 2.05 USD Billion in 2024 to an anticipated 8.59 USD Billion by 2035, reflecting a compound annual growth rate (CAGR) of 13.91% from 2025 to 2035. Such advancements not only improve patient safety but also streamline pharmacy operations, thereby enhancing overall healthcare delivery.

Technological Advancements in Automation

Technological advancements play a critical role in shaping the Global Central Fill Pharmacy Automation System Market Industry. Innovations such as artificial intelligence and machine learning are being integrated into pharmacy automation systems, enhancing their capabilities in medication management and patient safety. These technologies facilitate real-time data analysis and improve decision-making processes, which are essential for modern pharmacy operations. As a result, the market is expected to grow significantly, with projections indicating an increase from 2.05 USD Billion in 2024 to 8.59 USD Billion by 2035, driven by a CAGR of 13.91% from 2025 to 2035.

Cost Efficiency and Operational Streamlining

Cost efficiency remains a pivotal driver within the Global Central Fill Pharmacy Automation System Market Industry. By automating the medication dispensing process, pharmacies can significantly reduce labor costs and minimize the risk of human error. The implementation of these systems allows for better inventory management and reduces waste, which is crucial in an era where healthcare costs are under scrutiny. As the market evolves, the financial benefits associated with automation are likely to attract more stakeholders, contributing to the projected growth from 2.05 USD Billion in 2024 to 8.59 USD Billion by 2035.