Consumer Preferences

Shifting consumer preferences significantly influence the Polystyrene and Acrylonitrile Butadiene Styrene for Home Appliances Market. As consumers increasingly seek durable, lightweight, and aesthetically pleasing products, the demand for polystyrene and acrylonitrile butadiene styrene is on the rise. These materials are favored for their versatility and ability to be molded into various shapes and designs, making them ideal for modern home appliances. Market Research Future indicates that approximately 70% of consumers prioritize product design and functionality when making purchasing decisions. This trend suggests that manufacturers who focus on innovative designs and user-friendly features are likely to capture a larger market share, thereby driving the overall growth of the industry.

Regulatory Compliance

Regulatory compliance is becoming increasingly critical in the Polystyrene and Acrylonitrile Butadiene Styrene for Home Appliances Market. Governments worldwide are implementing stricter regulations regarding the use of certain materials due to health and environmental concerns. This has prompted manufacturers to seek alternatives that meet safety standards while maintaining product performance. For instance, regulations concerning the use of flame retardants in home appliances have led to a shift towards safer formulations of polystyrene and acrylonitrile butadiene styrene. Compliance with these regulations not only ensures market access but also enhances brand reputation, as consumers are more likely to trust products that adhere to safety standards. This focus on compliance is expected to drive innovation and growth within the industry.

Sustainability Initiatives

The increasing emphasis on sustainability within the Polystyrene and Acrylonitrile Butadiene Styrene for Home Appliances Market is driving demand for eco-friendly materials. Manufacturers are increasingly adopting sustainable practices, such as using recycled materials and reducing waste in production processes. This shift is not only in response to consumer preferences but also due to regulatory pressures aimed at minimizing environmental impact. As a result, the market for polystyrene and acrylonitrile butadiene styrene is expected to grow, with projections indicating a compound annual growth rate of approximately 4.5% over the next five years. This trend suggests that companies prioritizing sustainability may gain a competitive edge, appealing to environmentally conscious consumers.

Technological Advancements

Technological advancements play a pivotal role in shaping the Polystyrene and Acrylonitrile Butadiene Styrene for Home Appliances Market. Innovations in manufacturing processes, such as improved polymerization techniques, enhance the performance characteristics of these materials. For instance, advancements in injection molding technology allow for more precise and efficient production of home appliances, leading to reduced material waste and improved product quality. Furthermore, the integration of smart technologies into home appliances is driving the demand for high-performance materials like acrylonitrile butadiene styrene, which offers superior durability and heat resistance. This technological evolution is expected to propel market growth, with estimates suggesting a market size increase of around 6% annually.

Market Expansion Opportunities

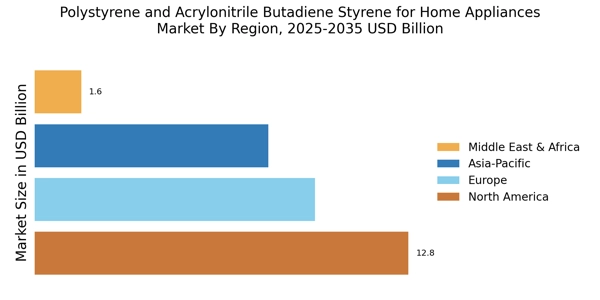

The Polystyrene and Acrylonitrile Butadiene Styrene for Home Appliances Market is witnessing numerous expansion opportunities, particularly in emerging markets. As urbanization continues to rise, there is an increasing demand for home appliances that are both functional and stylish. This trend is particularly evident in regions experiencing rapid economic growth, where consumers are investing in modern home solutions. Market analysts project that the demand for polystyrene and acrylonitrile butadiene styrene in these regions could increase by as much as 8% annually over the next few years. Companies that strategically position themselves to tap into these emerging markets may find lucrative opportunities for growth, thereby enhancing their overall market presence.