Regulatory Pressures and Compliance

Regulatory pressures are becoming a significant driver for the Plastics Gap Packaging Filler Market. Governments worldwide are implementing stricter regulations regarding plastic usage and waste management. These regulations compel manufacturers to seek alternative materials and innovative solutions that comply with environmental standards. For instance, the European Union's Single-Use Plastics Directive aims to reduce plastic waste, prompting companies to explore sustainable packaging options. This shift not only addresses regulatory compliance but also aligns with consumer expectations for responsible business practices. As a result, the Plastics Gap Packaging Filler Market is likely to see an increase in demand for compliant packaging fillers that meet these regulatory requirements, fostering innovation and sustainability.

Consumer Preferences for Customization

Consumer preferences are evolving towards personalized and customized products, which is influencing the Plastics Gap Packaging Filler Market. As brands strive to create unique customer experiences, the demand for tailored packaging solutions is on the rise. Customization allows companies to differentiate their products in a crowded marketplace, enhancing brand loyalty. Recent surveys indicate that over 60% of consumers are willing to pay more for personalized products, highlighting the potential for growth in this segment. This trend is prompting manufacturers to develop flexible packaging fillers that can accommodate various shapes and sizes, thereby meeting diverse consumer needs. Consequently, the Plastics Gap Packaging Filler Market is expected to adapt to these changing preferences, fostering innovation in packaging design and functionality.

Growth of E-commerce and Online Retail

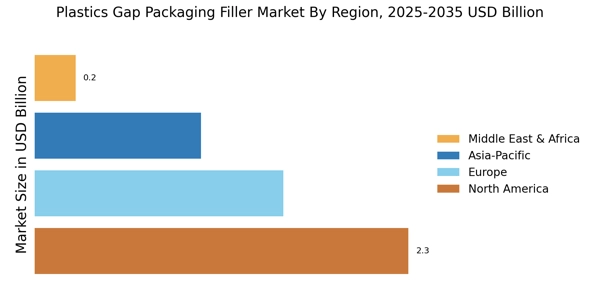

The rapid expansion of e-commerce is reshaping the Plastics Gap Packaging Filler Market. As online shopping continues to gain traction, the demand for effective packaging solutions that ensure product safety during transit is increasing. E-commerce platforms require packaging fillers that can withstand the rigors of shipping while minimizing waste. Recent statistics indicate that e-commerce sales are expected to surpass USD 4 trillion by 2025, creating a substantial market for packaging solutions. This growth necessitates the development of fillers that not only protect products but also enhance the unboxing experience for consumers. Consequently, the Plastics Gap Packaging Filler Market is likely to experience heightened demand as businesses adapt to the evolving landscape of online retail.

Technological Innovations in Packaging

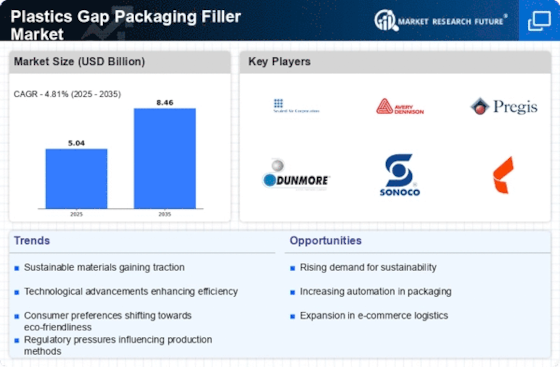

Technological advancements are significantly influencing the Plastics Gap Packaging Filler Market. Innovations in material science and manufacturing processes are enabling the development of more efficient and effective packaging solutions. For instance, the introduction of smart packaging technologies, which include sensors and indicators, enhances the functionality of packaging fillers. These technologies can monitor product conditions and provide real-time data, thereby improving supply chain efficiency. Furthermore, advancements in 3D printing are allowing for customized packaging solutions that cater to specific product requirements. The market is expected to grow at a CAGR of 5% over the next five years, driven by these technological innovations. As companies seek to differentiate their products, the Plastics Gap Packaging Filler Market is poised for transformation through these cutting-edge developments.

Rising Demand for Sustainable Packaging Solutions

The increasing emphasis on sustainability is driving the Plastics Gap Packaging Filler Market. Consumers and businesses alike are becoming more environmentally conscious, leading to a demand for eco-friendly packaging solutions. This trend is reflected in the growing preference for biodegradable and recyclable materials. According to recent data, the market for sustainable packaging is projected to reach USD 500 billion by 2027, indicating a robust growth trajectory. Companies are now investing in innovative materials that reduce environmental impact while maintaining product integrity. This shift not only aligns with consumer preferences but also helps companies comply with stringent regulations regarding plastic usage. As a result, the Plastics Gap Packaging Filler Market is likely to witness a surge in demand for sustainable fillers that meet these evolving standards.