Polymer Filler Market Summary

As per Market Research Future analysis, the Polymer Fillers Market Size was estimated at 50.91 USD Billion in 2024. The Polymer Fillers industry is projected to grow from 52.29 USD Billion in 2025 to 68.33 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 2.71% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Polymer Fillers Market is poised for substantial growth driven by sustainability and technological advancements.

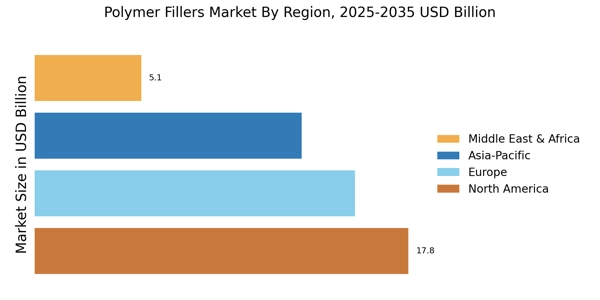

- The North American region remains the largest market for polymer fillers, reflecting a strong demand across various industries.

- Asia-Pacific is emerging as the fastest-growing region, propelled by rapid industrialization and increasing manufacturing capabilities.

- Organic fillers dominate the market, while inorganic fillers are witnessing the fastest growth due to their diverse applications.

- Key market drivers include rising demand in the construction sector and innovations in polymer technology, particularly in packaging solutions.

Market Size & Forecast

| 2024 Market Size | 50.91 (USD Billion) |

| 2035 Market Size | 68.33 (USD Billion) |

| CAGR (2025 - 2035) | 2.71% |

Major Players

BASF SE (DE), DuPont de Nemours Inc (US), Evonik Industries AG (DE), Clariant AG (CH), SABIC (SA), 3M Company (US), Ferro Corporation (US), Kraton Corporation (US), Solvay SA (BE)