Cost Efficiency

Cost efficiency remains a crucial driver for the plastic pallets Market. Businesses are continually seeking ways to reduce operational costs while maintaining quality and efficiency. Plastic pallets, with their longer lifespan and lower maintenance requirements compared to wooden pallets, offer a cost-effective solution for many companies. The initial investment in plastic pallets may be higher, but the long-term savings associated with durability and reduced replacement costs are compelling. Additionally, the ability to clean and sanitize plastic pallets easily makes them a preferred choice in industries such as food and pharmaceuticals, where hygiene is paramount. This focus on cost efficiency suggests that the Plastic Pallets Market is likely to experience sustained growth as more companies recognize the financial benefits of switching to plastic alternatives.

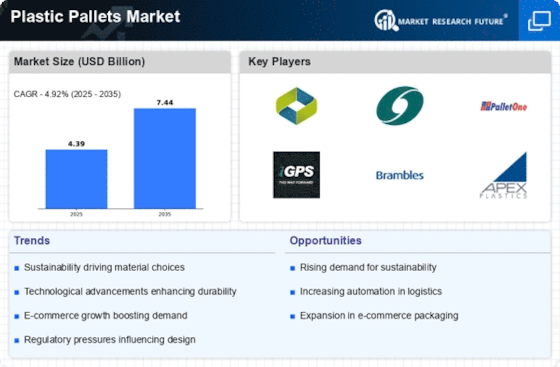

E-commerce Expansion

The rapid expansion of e-commerce is driving significant changes in the Plastic Pallets Market. As online shopping continues to gain traction, the need for efficient logistics and supply chain solutions becomes paramount. Plastic pallets, known for their durability and lightweight properties, are increasingly favored for transporting goods in e-commerce operations. The rise in online retail sales has led to a corresponding increase in demand for packaging and shipping materials, including plastic pallets. Market data indicates that the e-commerce sector is expected to grow at a robust rate, further propelling the need for effective pallet solutions. This trend underscores the critical role that plastic pallets play in facilitating the logistics of e-commerce, thereby enhancing their market presence.

Regulatory Compliance

Regulatory compliance is increasingly influencing the dynamics of the Plastic Pallets Market. Governments and regulatory bodies are implementing stringent guidelines regarding packaging and transportation materials, particularly in sectors like food safety and pharmaceuticals. Plastic pallets, which can be manufactured to meet specific hygiene and safety standards, are becoming essential for companies aiming to comply with these regulations. The ability to customize plastic pallets to meet various industry standards enhances their appeal. As compliance becomes more critical, businesses are likely to invest in plastic pallets that align with regulatory requirements, thereby driving market growth. This trend indicates that the Plastic Pallets Market is not only responding to market demands but also adapting to the evolving regulatory landscape.

Technological Innovations

Technological advancements are reshaping the Plastic Pallets Market in profound ways. Innovations such as automated pallet handling systems and smart pallets equipped with tracking technology are becoming increasingly prevalent. These technologies not only enhance operational efficiency but also improve inventory management and reduce losses. The integration of Internet of Things (IoT) devices into plastic pallets allows for real-time monitoring of goods, which is particularly beneficial in sectors like food and pharmaceuticals. As companies seek to optimize their supply chains, the demand for technologically advanced plastic pallets is expected to grow. This trend suggests that the Plastic Pallets Market is on the brink of a technological revolution, potentially leading to increased market penetration and diversification of product offerings.

Sustainability Initiatives

The increasing emphasis on sustainability appears to be a pivotal driver for the Plastic Pallets Market. Companies are increasingly adopting eco-friendly practices, leading to a surge in demand for recyclable and reusable plastic pallets. This shift is not merely a trend but a response to regulatory pressures and consumer preferences for sustainable products. In fact, the market for sustainable packaging solutions, which includes plastic pallets, is projected to reach substantial figures in the coming years. As organizations strive to reduce their carbon footprint, the adoption of plastic pallets, which are lighter and more durable than traditional materials, is likely to rise. This trend indicates a broader movement towards sustainability within the logistics and supply chain sectors, thereby enhancing the growth prospects of the Plastic Pallets Market.