Market Trends

Key Emerging Trends in the Plastic Compounding Market

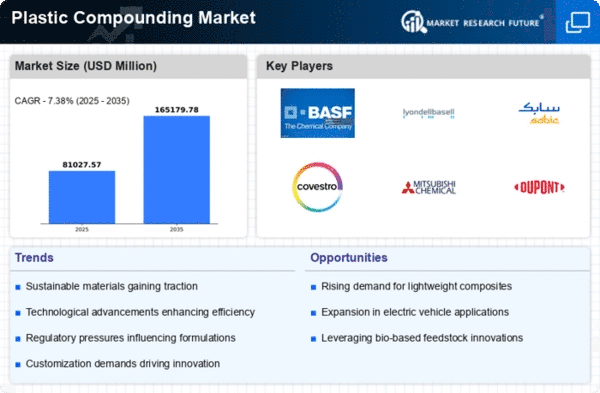

The Plastic Compounding Market is experiencing dynamic trends emanating from such factors as technological advancements, increased demand for high-performance materials, environmental concerns, and changing regulatory landscapes. One of the major developments is the increasing market for engineered plastics and polymer compounds that has improved properties like strength against impact, flame retardancy and durability.

Besides, the circular economy has a significant influence on Plastic Compounding Market trends. Producers are putting more emphasis on sustainable sourcing of raw materials, recycling solutions and development of biodegradable and bio-based plastics. This reveals how the sector is responding to environmental issues and emphasizing lessening plastic’s effect on climate change by production or use. Closed-loop systems coupled with circular design principles are being embraced in trying to produce more sustainable as well as eco-friendly plastic compounds.

Technological innovations in compounding processes are shaping market trends in the Plastic Compounding Market. More advanced compounding technologies such as twin screw extrusion and reactive extrusion have enhanced the blending of polymer resins and additives hence resulting in better performing customizable compounds. This trend is critical for meeting changing requirements of plastic compound users since it offers tailored solutions with enhanced properties.

The growing regulation regarding plastic waste disposal and its negative effects on environment has also affected how Plastic Compounding Market operates. The industry is transitioning towards more sustainable and compliant alternatives due to measures that restrict the use of certain additives, enhance recyclability as well as reduce plastic waste Governments have made investments into R&D aimed at ensuring that their respective regulations concerning plastics are met by stakeholders involved in manufacturing these items through ensuring this companies provide a level playing field for industries seeking environment responsible material options.

E-commerce plays a role in reconfiguring distribution channels for plastic compounds within an online market place. Plastics buyers’ behavior today influenced by convenience offered by online platforms when sourcing materials, comparing products or placing orders.The manufacturers and distributors therefore respond to this trend by improving their online presence with detailed product information plus efficient deliveries. This makes the plastic compounds more accessible through e-commerce contributing to broader market coverage and streamlined procurement.

The COVID-19 pandemic has made the Plastic Compounding Market’s trends to become more resilient and adaptable. Reliable and diversified supply chains have been highlighted by the pandemic as logistics disruptions at a global scale as well as unavailability of raw materials within the industry posed a challenge. The focus for companies is now on risk management, flexible supply chain, regional sourcing so that there is continuity even when there are unexpected market shocks.

Leave a Comment