Shift Towards Personalized Healthcare

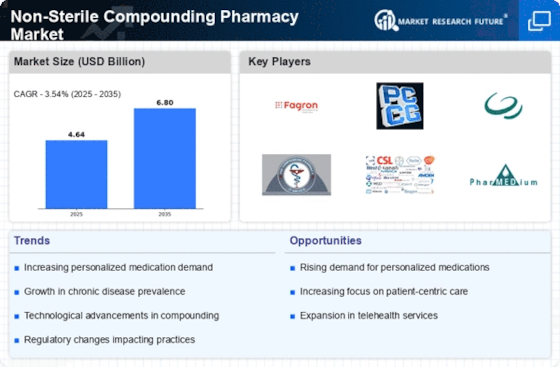

The movement towards personalized healthcare is reshaping the Non-Sterile Compounding Pharmacy Market. Patients are increasingly seeking medications that are specifically tailored to their unique health needs, which compounding pharmacies are well-positioned to provide. This shift is supported by advancements in pharmacogenomics, which allow for more precise medication formulations based on individual genetic profiles. As healthcare providers recognize the benefits of personalized treatment plans, the demand for compounded medications is expected to rise. Market data suggests that the personalized medicine sector is projected to grow significantly, potentially reaching billions in revenue, thereby enhancing the role of non-sterile compounding pharmacies in delivering customized therapeutic solutions.

Rising Awareness of Compounding Services

There is a growing awareness among healthcare professionals and patients regarding the benefits of compounding services, which is likely to drive the Non-Sterile Compounding Pharmacy Market. Educational initiatives and outreach programs have contributed to this increased awareness, highlighting the advantages of customized medications for specific patient needs. As more practitioners recognize the potential of compounded medications to address unique health challenges, the demand for these services is expected to rise. Additionally, the increasing number of patients seeking alternatives to commercially available drugs, due to allergies or specific dosage requirements, further supports this trend. This heightened awareness could lead to a substantial increase in the market share of non-sterile compounding pharmacies.

Increasing Prevalence of Chronic Diseases

The rising incidence of chronic diseases such as diabetes, hypertension, and cancer appears to be a significant driver for the Non-Sterile Compounding Pharmacy Market. As these conditions often require tailored medication regimens, compounding pharmacies are increasingly sought after to create personalized formulations. According to recent data, chronic diseases account for approximately 70% of all deaths, underscoring the urgent need for customized treatment options. This trend suggests that compounding pharmacies will play a crucial role in managing these conditions, thereby expanding their market presence. Furthermore, the growing aging population, which is more susceptible to chronic ailments, is likely to further fuel demand for non-sterile compounded medications, indicating a robust growth trajectory for the industry.

Regulatory Support for Compounding Pharmacies

Regulatory frameworks that support the operations of compounding pharmacies are emerging as a key driver for the Non-Sterile Compounding Pharmacy Market. Recent legislative changes have aimed to streamline the compounding process while ensuring patient safety. These regulations provide a clearer pathway for compounding pharmacies to operate, thereby encouraging more establishments to enter the market. Furthermore, as regulatory bodies continue to recognize the importance of compounded medications in patient care, there is potential for increased funding and resources directed towards these pharmacies. This supportive regulatory environment may enhance the credibility and operational capabilities of non-sterile compounding pharmacies, fostering growth within the industry.

Technological Innovations in Compounding Practices

Technological advancements are playing a pivotal role in transforming the Non-Sterile Compounding Pharmacy Market. Innovations such as automated compounding systems and advanced formulation software are enhancing the efficiency and accuracy of compounding processes. These technologies not only improve the quality of compounded medications but also reduce the risk of human error, which is critical in patient safety. As compounding pharmacies adopt these technologies, they are likely to see an increase in operational capacity and a reduction in turnaround times for medication preparation. Market analysis indicates that the integration of technology in compounding practices could lead to a significant uptick in demand for non-sterile compounded products, thereby driving industry growth.