Rising Patient-Centric Approaches

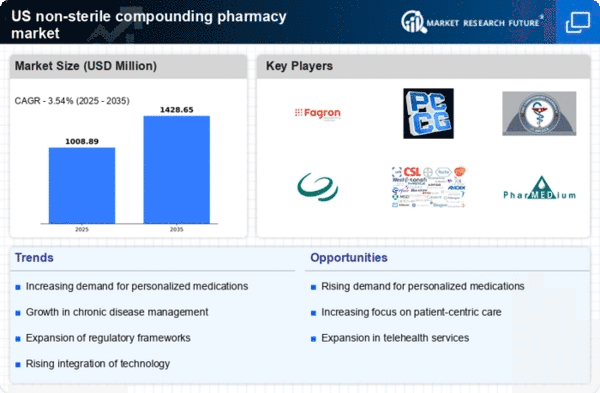

The non sterile-compounding-pharmacy market is experiencing a notable shift towards patient-centric approaches. This trend is driven by an increasing demand for personalized medications tailored to individual patient needs. As healthcare providers emphasize customized treatment plans, compounding pharmacies are positioned to meet these requirements effectively. The market is projected to grow at a CAGR of approximately 6.5% over the next five years, reflecting the rising preference for individualized therapies. Furthermore, the ability of compounding pharmacies to create unique formulations enhances patient satisfaction and adherence to treatment regimens. This focus on patient-centricity not only fosters loyalty but also expands the market reach of non sterile-compounding pharmacies, as they cater to diverse patient populations with specific health conditions.

Expanding Scope of Pharmacy Services

The non sterile-compounding-pharmacy market is benefiting from an expanding scope of pharmacy services. As healthcare systems evolve, pharmacies are increasingly taking on roles beyond traditional dispensing, including medication management and patient education. This shift allows compounding pharmacies to offer a broader range of services, thereby attracting more patients. The integration of clinical services into pharmacy practice is projected to enhance the overall value proposition of non sterile-compounding pharmacies. By providing comprehensive care, these pharmacies can improve patient outcomes and foster stronger relationships with healthcare providers. This trend is likely to contribute to a market growth rate of around 5% annually, as pharmacies adapt to meet the changing needs of the healthcare landscape.

Increased Prevalence of Chronic Diseases

The prevalence of chronic diseases in the United States is a significant driver for the non sterile-compounding-pharmacy market. Conditions such as diabetes, hypertension, and arthritis require ongoing management, often necessitating customized medication solutions. As the population ages and the incidence of these diseases rises, the demand for tailored pharmaceutical products is expected to increase. According to recent statistics, nearly 60% of adults in the US live with at least one chronic condition, creating a substantial market opportunity for compounding pharmacies. These pharmacies can provide specialized formulations that address the unique needs of patients, thereby enhancing treatment efficacy and improving quality of life. This growing patient base is likely to propel the non sterile-compounding-pharmacy market forward in the coming years.

Regulatory Support for Compounding Practices

Regulatory support plays a pivotal role in shaping the non sterile-compounding-pharmacy market. Recent initiatives aimed at streamlining regulations for compounding practices have created a more favorable environment for pharmacies. This support is essential for ensuring that compounding pharmacies can operate efficiently while maintaining high standards of safety and quality. The FDA has been actively working to clarify guidelines, which may lead to increased confidence among pharmacists and patients alike. As regulatory frameworks become more supportive, compounding pharmacies are likely to expand their operations and service offerings. This trend could result in a market growth rate of approximately 4% over the next few years, as pharmacies capitalize on the opportunities presented by a more conducive regulatory landscape.

Technological Integration in Compounding Processes

Technological integration is transforming the non sterile-compounding-pharmacy market by enhancing the efficiency and accuracy of compounding processes. Advanced compounding equipment and software solutions are being adopted to streamline operations, reduce errors, and improve product quality. Automation in compounding not only increases productivity but also ensures compliance with regulatory standards, which is crucial in maintaining patient safety. The market is witnessing a shift towards the use of sophisticated compounding technologies, which could potentially lead to a reduction in operational costs by up to 15%. As pharmacies embrace these innovations, they are likely to enhance their competitive edge and expand their service offerings, thereby driving growth in the non sterile-compounding-pharmacy market.