Regulatory Pressures

The Pipeline Monitoring System Market is significantly influenced by regulatory pressures aimed at ensuring environmental protection and public safety. Governments worldwide are implementing stringent regulations that mandate the use of advanced monitoring systems for pipelines. For instance, regulations in various regions require real-time monitoring of pipeline conditions to prevent leaks and spills. This regulatory landscape is compelling companies to invest in sophisticated monitoring technologies, thereby propelling market growth. As compliance becomes increasingly critical, the Pipeline Monitoring System Market is expected to expand, with organizations prioritizing investments in systems that meet or exceed regulatory requirements.

Technological Advancements

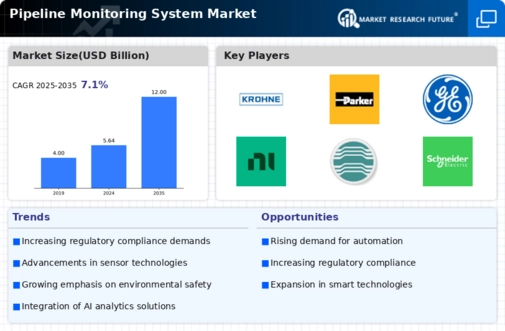

The Pipeline Monitoring System Market is experiencing a surge in technological advancements, particularly in the realm of sensor technology and data analytics. Innovations such as IoT-enabled sensors and machine learning algorithms are enhancing the ability to detect leaks and monitor pipeline integrity in real-time. According to recent data, the integration of advanced technologies is projected to increase the efficiency of pipeline monitoring systems by up to 30%. This trend not only improves operational efficiency but also reduces the risk of environmental hazards, thereby driving demand for sophisticated monitoring solutions. As companies seek to leverage these advancements, the Pipeline Monitoring System Market is likely to witness substantial growth, with investments in technology expected to rise significantly.

Environmental Sustainability Initiatives

The Pipeline Monitoring System Market is witnessing a shift towards environmental sustainability initiatives, driven by growing public concern over climate change and ecological preservation. Companies are increasingly adopting monitoring systems that not only enhance operational efficiency but also minimize environmental impact. The integration of eco-friendly technologies in pipeline monitoring is becoming a priority, as organizations seek to reduce their carbon footprint. Recent studies suggest that investments in sustainable monitoring solutions could lead to a 20% reduction in emissions associated with pipeline operations. This trend towards sustainability is likely to bolster the Pipeline Monitoring System Market, as stakeholders recognize the importance of aligning with environmental goals.

Increasing Demand for Safety and Security

Safety and security concerns are paramount in the Pipeline Monitoring System Market, particularly in sectors such as oil and gas. The increasing frequency of pipeline incidents has heightened awareness regarding the need for robust monitoring systems. Data indicates that The Pipeline Monitoring System Market is anticipated to reach USD 10 billion by 2026, reflecting a growing emphasis on safety measures. Companies are increasingly adopting advanced monitoring solutions to mitigate risks associated with leaks and ruptures, which can lead to catastrophic consequences. This heightened focus on safety is driving the demand for comprehensive pipeline monitoring systems, as organizations strive to protect both their assets and the environment.

Rising Investment in Infrastructure Development

The Pipeline Monitoring System Market is benefiting from rising investments in infrastructure development across various sectors, including energy, water, and transportation. As countries prioritize the modernization of their pipeline networks, the demand for effective monitoring systems is escalating. Recent reports indicate that infrastructure spending is projected to grow by 5% annually, creating a favorable environment for the adoption of advanced pipeline monitoring technologies. This influx of investment is likely to drive innovation and enhance the capabilities of monitoring systems, ensuring that they meet the evolving needs of the industry. Consequently, the Pipeline Monitoring System Market is poised for robust growth as infrastructure projects continue to expand.