Rising Environmental Regulations

The pipeline monitoring-system market is significantly influenced by the rising environmental regulations imposed by federal and state authorities. As environmental protection becomes a priority, companies are compelled to adopt advanced monitoring systems to comply with stringent regulations. The Environmental Protection Agency (EPA) has established guidelines that necessitate regular monitoring and reporting of pipeline conditions. This regulatory landscape is driving investments in technologies that can provide accurate data and ensure compliance. The market is projected to expand as organizations seek to avoid penalties and enhance their environmental stewardship. Consequently, the pipeline monitoring-system market is likely to benefit from the increasing need for compliance-driven solutions, fostering innovation and growth.

Increasing Demand for Safety and Security

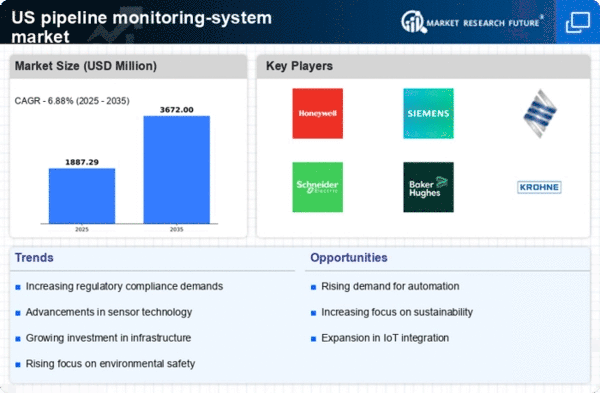

The pipeline monitoring-system market is experiencing a notable surge in demand driven by heightened safety and security concerns. As incidents of pipeline leaks and ruptures have raised alarms, stakeholders are increasingly investing in advanced monitoring systems to mitigate risks. The market is projected to grow at a CAGR of approximately 7.5% over the next five years, reflecting a strong emphasis on safeguarding infrastructure. Companies are prioritizing the implementation of real-time monitoring technologies to ensure compliance with safety regulations. This trend is particularly pronounced in sectors such as oil and gas, where the financial implications of accidents can be substantial. The pipeline monitoring-system market is thus positioned to benefit from this growing focus on safety, as organizations seek to protect both their assets and the environment.

Integration of IoT and Smart Technologies

The integration of Internet of Things (IoT) and smart technologies is revolutionizing the pipeline monitoring-system market. By leveraging IoT devices, companies can achieve enhanced data collection and analysis capabilities, leading to more efficient monitoring processes. This technological evolution allows for predictive maintenance, reducing downtime and operational costs. The market is expected to witness a significant increase in the adoption of smart sensors and automated systems, which can provide real-time insights into pipeline conditions. As organizations strive for operational excellence, the pipeline monitoring-system market is likely to see a shift towards more interconnected and intelligent solutions. This trend not only improves efficiency but also aligns with the broader industry movement towards digital transformation.

Growing Investment in Infrastructure Development

The pipeline monitoring-system market is poised for growth due to the increasing investment in infrastructure development across the United States. As the government and private sector allocate substantial funds towards upgrading aging infrastructure, the demand for effective monitoring systems is expected to rise. The American Society of Civil Engineers (ASCE) has highlighted the need for improved infrastructure, which includes pipelines. This investment trend is likely to drive the adoption of advanced monitoring technologies that can ensure the integrity and safety of new and existing pipelines. The pipeline monitoring-system market stands to gain from this influx of capital, as stakeholders seek to implement robust solutions that can support infrastructure resilience.

Emergence of Data Analytics in Monitoring Solutions

The emergence of data analytics is transforming the pipeline monitoring-system market by enabling more informed decision-making. Advanced analytics tools allow companies to process vast amounts of data generated by monitoring systems, leading to actionable insights. This capability enhances the ability to predict potential failures and optimize maintenance schedules. As organizations increasingly recognize the value of data-driven strategies, the pipeline monitoring-system market is likely to see a rise in the adoption of analytics-integrated solutions. This trend not only improves operational efficiency but also contributes to cost savings, making it an attractive proposition for stakeholders. The integration of data analytics into monitoring systems is expected to be a key driver of innovation and growth in the market.