Growing Demand for Herbal Products

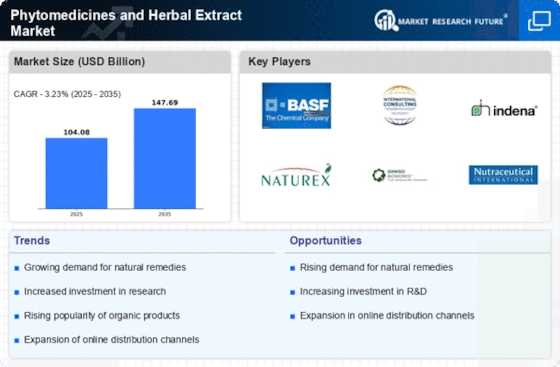

The Phytomedicines and Herbal Extract Market experiences a notable surge in demand for herbal products, driven by a shift in consumer preferences towards natural and organic alternatives. This trend is largely influenced by increasing awareness of the potential side effects associated with synthetic pharmaceuticals. As consumers become more health-conscious, they are gravitating towards herbal remedies that are perceived as safer and more effective. Market data indicates that the herbal supplement segment is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This growth reflects a broader acceptance of herbal products in mainstream healthcare, suggesting that the Phytomedicines and Herbal Extract Market is poised for substantial expansion.

Regulatory Support for Herbal Medicines

The Phytomedicines and Herbal Extract Market benefits from increasing regulatory support for herbal medicines. Governments and health authorities are recognizing the therapeutic potential of phytomedicines, leading to the establishment of guidelines and standards for their use. This regulatory framework not only enhances consumer confidence but also encourages manufacturers to invest in research and development. For instance, several countries have implemented policies that promote the integration of herbal medicines into national healthcare systems. Such initiatives are likely to bolster the market, as they provide a structured environment for the growth of the Phytomedicines and Herbal Extract Market, potentially increasing its legitimacy and acceptance among healthcare professionals.

Rising Interest in Preventive Healthcare

The Phytomedicines and Herbal Extract Market is significantly influenced by the rising interest in preventive healthcare. As individuals become more proactive about their health, there is a growing inclination towards natural remedies that can enhance well-being and prevent diseases. This trend is reflected in the increasing consumption of herbal supplements and extracts, which are often perceived as a means to maintain health rather than merely treat ailments. Market analysis suggests that the preventive healthcare segment is expanding rapidly, with consumers seeking products that support immune function, digestive health, and overall vitality. This shift towards preventive measures is likely to drive the Phytomedicines and Herbal Extract Market forward, as more individuals incorporate herbal solutions into their daily health regimens.

Increasing Popularity of Herbal Cosmetics

The Phytomedicines and Herbal Extract Market is witnessing a rise in the popularity of herbal cosmetics, which is contributing to its overall growth. Consumers are increasingly seeking beauty and personal care products that incorporate natural ingredients, driven by concerns over the safety and environmental impact of synthetic chemicals. This trend is evident in the booming market for herbal skincare and haircare products, which are often marketed as being gentler and more effective. Market data suggests that the herbal cosmetics segment is expected to grow at a robust rate, reflecting a shift in consumer behavior towards more sustainable and health-conscious choices. This growing interest in herbal cosmetics is likely to further enhance the Phytomedicines and Herbal Extract Market, as it opens new avenues for product development and innovation.

Technological Advancements in Extraction Methods

Technological advancements in extraction methods are playing a pivotal role in the Phytomedicines and Herbal Extract Market. Innovations such as supercritical fluid extraction and ultrasonic extraction are enhancing the efficiency and quality of herbal extracts. These methods not only improve yield but also preserve the bioactive compounds that contribute to the efficacy of phytomedicines. As a result, manufacturers are able to produce higher-quality products that meet the increasing consumer demand for potent herbal remedies. The adoption of these advanced extraction techniques is likely to foster growth within the Phytomedicines and Herbal Extract Market, as they enable companies to differentiate their offerings and cater to a more discerning customer base.