Market Share

Phenolic Resins Market Share Analysis

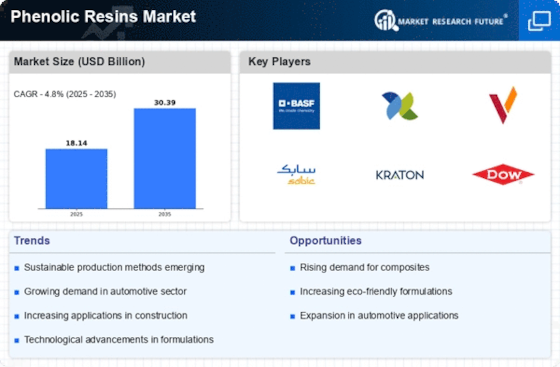

In the highly competitive landscape of the phenolic resin market, different companies employ various strategies to position themselves in order to gain a competitive edge over rivals, hence carving a niche for themselves within the industry. One popular strategy is differentiation, where firms concentrate on creating distinctive features or qualities in their phenolic resins that set them apart from competitors. Another key strategy is cost leadership which revolves around production process optimization aimed at reducing manufacturing costs through economies of scale being achieved. The material is highly durable; thus, it is used in the molding process, as well as in abrasives, adhesives, laminations, and insulator materials, among others. The two types are Novolac and Resol phenolic resins. While resol is synthesized under normal conditions, novolac is formed under acidic conditions using excess phenol. This shows that there would be more growth in demand for phenolic resin over the next five years. Companies in the phenolic resin market employ another key strategy: market segmentation. This means that companies divide the market into separate fragments according to their application, end users, or geographic location so that they can meet each segment's specific needs. Strategic partnerships and collaborations are also important for a position on a market share within the Phenolic Resins Market. This is done through alliances with distributors, suppliers, or even research organizations to tap new markets, enhance capabilities, and exploit one another's strengths. Such partnerships lead to synergies, which help a business become more competitive and grow with its partners. Such collaborations may be characterized by sharing resources and increasing market reach while coming up with innovative products in such a way that strengthens the company's hold in the market. Additionally, focusing on customer-centric strategies helps ensure long-term success in the Phenolic resin market. Excellent service delivery, reliable product quality, and responsive support systems that create good relations with customers can promote loyalty and lead to repeat business. Satisfied clients are potential brand evangelists who recommend firms to other consumers, thereby improving corporate image and attracting new clients to buy their products from them. The phenolic resin markets have become very competitive, forcing companies to seek diverse approaches to positioning themselves within this market. Firms try to differentiate themselves from competitors based on differentiation, cost leadership approach, geographic area segmentation, strategic alliances, and customer orientation, among others.

Leave a Comment