Market Trends

Key Emerging Trends in the Phenolic Resins Market

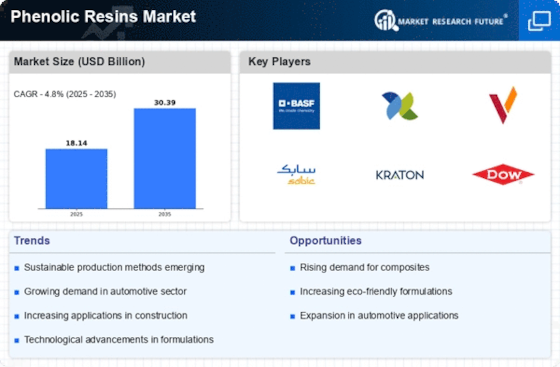

Phenolic resins have maintained dynamic trends over time, reflecting changes in the landscape of industries that greatly rely on these versatile materials. In recent years, demand for phenolic resins has been on an upward trend across diverse sectors due to their unique thermal and mechanical characteristics. This has led to increased usage of phenolic resins in auto parts manufacturing, which is one of the major trends shaping the market. Moreover, the construction sector as well has shown a growing interest in phenolic resins as they are used in the manufacture of laminates, adhesives, and coatings used during the construction of buildings and infrastructures. The market for sustainable materials in the construction industry, therefore, leans towards phenolic resin solutions due to their low environmental impact and recyclability. A noticeable trend within the phenolic resins market is that companies are now focusing more on research & development so as to improve their performance attributes. Some manufacturers have made investments in improving their products so that they become less flammable or smokeless or easier to process with higher yields. Geographically, Asia-Pacific has emerged as a key player because it accounts for most consumption driven by rapid industrialization and infrastructure development, especially in countries like China and India, where its manufacturing industry, particularly automotive electronics, contributes immensely towards the rising demand for preload resin (phenols). Also, the electronics industry heavily relies on phenol resin for production,, such asprintingd circuit boards. The global demand for electronic gadgets has continued to create room for phenolic resins. Printed circuit boards in the electronics industry require materials that have good electrical insulation and are resistant to fire. However, there are a number of challenges hampering market growth, such as fluctuating raw material prices and increased use of substitute products. Petrochemical-based phenolic resins are usually subject to oil price fluctuations, which can affect their overall cost structure, thereby impacting both manufacturers and end users. The phenolic resins industry is underpinned by several dynamic trends triggered by different industries playing significant roles in the market's trajectory, notably the automotive, building and construction, and electronics sectors. Shifting markets coupled with ongoing R&D efforts contribute to the changing landscape of the Phenolic Resin Market. Despite these challenges, phenol resin stands out as an important material in various applications not only because it is innovative but also environmentally friendly given today's rapidly changing world market.

Leave a Comment