Increased Adoption in Emerging Markets

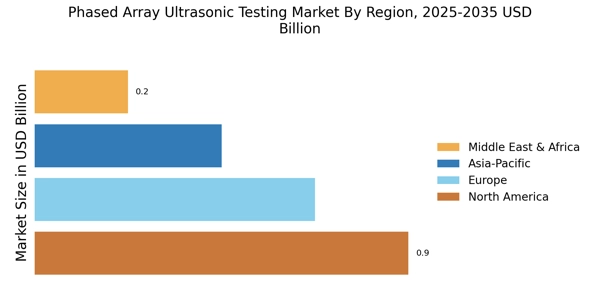

The Phased Array Ultrasonic Testing Market is witnessing increased adoption in emerging markets, where industrialization and modernization efforts are gaining momentum. Countries in Asia-Pacific, Latin America, and parts of Africa are investing heavily in their manufacturing and energy sectors, creating a demand for advanced testing solutions. Phased array ultrasonic testing offers a competitive advantage due to its efficiency and effectiveness in detecting flaws in materials. As these regions continue to develop their industrial capabilities, the phased array ultrasonic testing market is likely to expand, with projections indicating a potential doubling of market size in these areas over the next decade.

Growing Demand for Non-Destructive Testing

The Phased Array Ultrasonic Testing Market is experiencing a surge in demand for non-destructive testing (NDT) methods across various sectors, including aerospace, automotive, and energy. This demand is driven by the need for reliable inspection techniques that ensure safety and quality without damaging the materials being tested. As industries increasingly prioritize safety and compliance, the adoption of advanced NDT methods, such as phased array ultrasonic testing, is likely to rise. According to recent data, the NDT market is projected to grow at a compound annual growth rate (CAGR) of approximately 7% over the next few years, indicating a robust expansion that will benefit the phased array ultrasonic testing segment.

Regulatory Compliance and Safety Standards

The Phased Array Ultrasonic Testing Market is significantly influenced by stringent regulatory compliance and safety standards imposed by various governing bodies. Industries such as oil and gas, nuclear, and manufacturing are required to adhere to rigorous inspection protocols to ensure the integrity of their operations. The increasing emphasis on safety regulations is likely to drive the adoption of advanced testing methods, including phased array ultrasonic testing, which offers enhanced accuracy and efficiency. As organizations strive to meet these compliance requirements, the market for phased array ultrasonic testing is expected to witness substantial growth, with an estimated increase in market size projected to reach several billion dollars by the end of the decade.

Technological Innovations in Testing Equipment

The Phased Array Ultrasonic Testing Market is benefiting from continuous technological innovations in testing equipment. Advancements in electronics, software, and sensor technology have led to the development of more sophisticated phased array ultrasonic testing systems. These innovations enhance the capabilities of testing equipment, allowing for faster data acquisition, improved imaging, and more accurate defect detection. As industries seek to optimize their inspection processes, the demand for state-of-the-art phased array systems is likely to increase. Market analysts suggest that the integration of artificial intelligence and machine learning into testing equipment could further revolutionize the phased array ultrasonic testing landscape, potentially leading to a more efficient and effective inspection process.

Rising Investment in Infrastructure Development

The Phased Array Ultrasonic Testing Market is poised to benefit from rising investments in infrastructure development projects worldwide. Governments and private entities are increasingly allocating funds for the construction and maintenance of critical infrastructure, such as bridges, railways, and pipelines. These projects necessitate rigorous inspection and testing to ensure structural integrity and safety. Phased array ultrasonic testing, with its ability to provide detailed insights into material conditions, is likely to become a preferred choice for inspectors. As infrastructure spending continues to grow, the demand for phased array ultrasonic testing services is expected to rise, potentially leading to a significant increase in market share within the broader non-destructive testing sector.