Pet Packaging Size

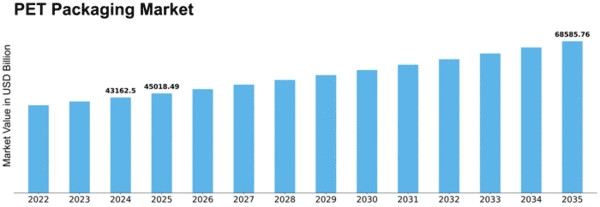

PET Packaging Market Growth Projections and Opportunities

Polyethylene Terephthalate (PET) packaging is impacted by numerous factors including consumer preferences and shifts in lifestyle. PET's lightness and durability are a few qualities that are consistently being improved in the wake of the rising demand for light products that can be maintained longer. PET is known for its excellent strength-to-weight ratio and has become an important component in the manufacturing of different items like beverages, foodstuffs, and personal care products. The property also makes it possible to save on transportation costs due to its lightweight characteristics as well as aligning with current eco-friendly emphasis towards cost-effective packaging solutions.

Consumer preference as well as change in lifestyle determines how PET packaging industry behaves. Furthermore there has been an increase in demand for pet bottles used in drinks or snacks due to the rise of mobile lifestyles. Aside from being clear hence allowing individuals choose among numerous brands available within store shelves these properties also make PET a suitable material for all packaged goods. Furthermore awareness about recyclability capabilities associated with certain materials encourages consumers’ use. Companies therefore need to develop environmentally friendly generation materials since peoples’ awareness levels have already risen regarding sustainable materials preferred by customers.

Market trends and competition dynamics shape this segment’s landscape.A typical full customization options offered through PET package designs have enabled some organizations stand out among others.In addition strategic alliances between suppliers converters end- users foster efficiency across entire supply chain thus enhance thriving eco-systems markets toward sustainable packages.

Increasing environmental concerns and campaigns against plastic pollution push companies towards greener alternatives to traditional plastic packaging.PET can be recycled however there are challenges relating to its disposal at end-of-life or management of plastic waste.This issue was resolved through continued efforts made towards promoting application of recycled PET (rPET) in packaging industry plus closure of recycling loop hence showing that the sector is strongly committed to sustainability.

Leave a Comment