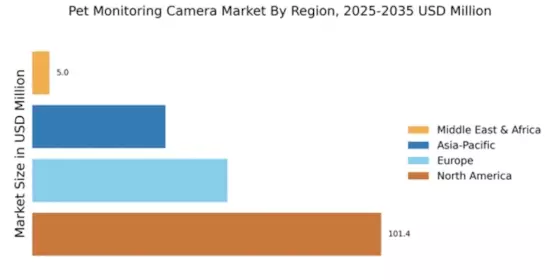

North America : Market Leader in Pet Tech

North America continues to lead the Pet Monitoring Camera Market, holding a significant share of 101.44 million in 2025. The growth is driven by increasing pet ownership, technological advancements, and a rising demand for remote pet monitoring solutions. Regulatory support for pet welfare and safety is also a catalyst for market expansion, encouraging innovation and investment in smart pet technology.

The competitive landscape is robust, with key players like Nest, Petcube, and Furbo dominating the market. The U.S. is the primary contributor, supported by a tech-savvy consumer base and high disposable income. Companies are focusing on enhancing product features, such as HD video and two-way audio, to attract pet owners. The presence of established brands ensures a dynamic market environment, fostering continuous growth and innovation.

Europe : Emerging Market for Pet Cameras

Europe's Pet Monitoring Camera Market is valued at 56.73 million in 2025, reflecting a growing trend towards pet care technology. Factors such as increasing pet ownership, urbanization, and a shift towards remote monitoring solutions are driving demand. Regulatory frameworks promoting animal welfare are also influencing market dynamics, encouraging the adoption of innovative pet care products.

Leading countries in this region include Germany, the UK, and France, where consumer awareness and spending on pet technology are rising. The competitive landscape features brands like Pawbo and Petzi, which are gaining traction. The market is characterized by a mix of established players and new entrants, all vying to capture the growing interest in pet monitoring solutions. This competitive environment is expected to foster innovation and enhance product offerings.

Asia-Pacific : Rapidly Growing Pet Market

The Asia-Pacific region, with a market size of 38.71 million in 2025, is witnessing rapid growth in the Pet Monitoring Camera Market. Factors such as rising disposable incomes, increasing pet ownership, and urban lifestyles are driving demand for innovative pet care solutions. Regulatory initiatives aimed at improving pet welfare are also contributing to market growth, creating a favorable environment for new technologies.

Countries like China, Japan, and Australia are leading the charge, with a growing number of consumers seeking advanced pet monitoring options. The competitive landscape includes both local and international players, such as Tenda and iPet, who are focusing on affordability and functionality. This region's unique market dynamics present opportunities for innovation and expansion, as pet owners increasingly prioritize the well-being of their pets.

Middle East and Africa : Niche Market with Potential

The Pet Monitoring Camera Market in the Middle East and Africa is valued at 5.0 million in 2025, representing a niche yet growing segment. Factors such as increasing pet ownership and a rising awareness of pet care technology are driving market interest. Regulatory frameworks are gradually evolving to support pet welfare, which is expected to further stimulate market growth in the coming years.

Countries like South Africa and the UAE are at the forefront, with a growing number of consumers looking for innovative pet solutions. The competitive landscape is still developing, with opportunities for both local and international brands to enter the market. As pet owners become more aware of the benefits of monitoring their pets remotely, the demand for pet cameras is anticipated to rise, paving the way for new entrants and innovations in the sector.