Regulatory Frameworks and Policies

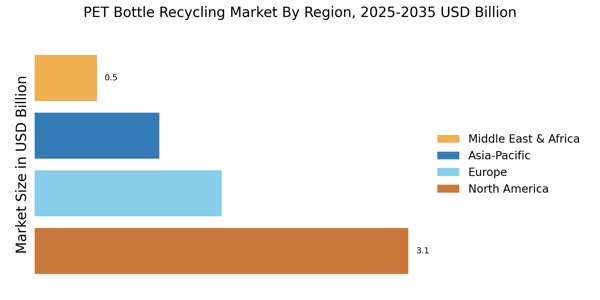

The PET Bottle Recycling Market is significantly influenced by the establishment of stringent regulatory frameworks aimed at promoting recycling initiatives. Governments are increasingly enacting policies that mandate recycling rates and impose penalties for non-compliance. For instance, several regions have introduced deposit return schemes that incentivize consumers to return their PET bottles for recycling. These regulations not only enhance recycling rates but also create a more structured market for recycled materials. As a result, the market is likely to witness a robust increase in demand for recycled PET, with projections indicating that regulatory support could lead to a 15% increase in recycling rates over the next five years.

Corporate Social Responsibility Initiatives

The PET Bottle Recycling Market is being positively impacted by the increasing commitment of corporations to corporate social responsibility (CSR) initiatives. Many companies are recognizing the importance of sustainable practices and are actively engaging in recycling programs. By investing in PET bottle recycling, these corporations not only enhance their brand image but also contribute to environmental conservation efforts. This trend is likely to foster partnerships between businesses and recycling facilities, creating a more integrated recycling ecosystem. As a result, the market may experience a surge in investment, with projections indicating that CSR initiatives could lead to a 10% increase in recycling capacity by 2026.

Economic Incentives and Market Opportunities

The PET Bottle Recycling Market is benefiting from various economic incentives that encourage recycling activities. Governments and organizations are offering financial support and subsidies to recycling facilities, which can enhance operational efficiency and reduce costs. Additionally, the growing market for recycled PET presents lucrative opportunities for investors and entrepreneurs. With the demand for sustainable materials on the rise, the economic viability of recycling operations is improving. Market analysis suggests that the profitability of recycled PET could increase by 12% over the next few years, driven by these economic incentives and the expanding market for eco-friendly products.

Technological Innovations in Recycling Processes

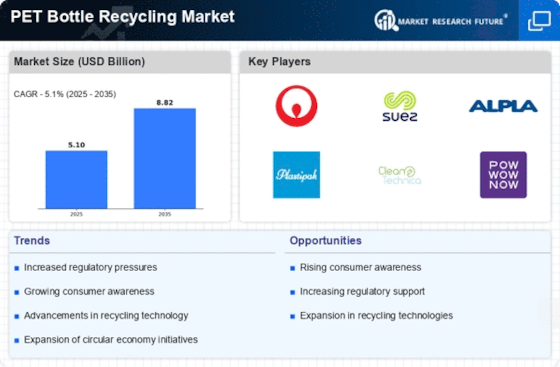

The PET Bottle Recycling Market is experiencing a surge in technological innovations that enhance recycling efficiency. Advanced sorting technologies, such as AI-driven systems, are being implemented to improve the separation of PET bottles from other materials. This not only increases the purity of recycled PET but also reduces contamination rates, which have been a persistent challenge in recycling efforts. Furthermore, innovations in chemical recycling methods are emerging, allowing for the breakdown of PET into its original monomers, thus enabling the production of high-quality recycled PET. As a result, the market is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years, driven by these technological advancements.

Rising Consumer Awareness and Demand for Sustainable Practices

The PET Bottle Recycling Market is witnessing a notable shift in consumer behavior, with an increasing emphasis on sustainability. Consumers are becoming more aware of the environmental impacts of plastic waste, leading to a heightened demand for products made from recycled materials. This trend is prompting manufacturers to incorporate recycled PET into their products, thereby driving the growth of the recycling market. Market data indicates that brands utilizing recycled materials can enhance their market appeal, as consumers are willing to pay a premium for sustainable products. This growing consumer preference is expected to propel the PET bottle recycling market, with estimates suggesting a potential market expansion of 20% in the next few years.