North America : Tech-Driven Market Growth

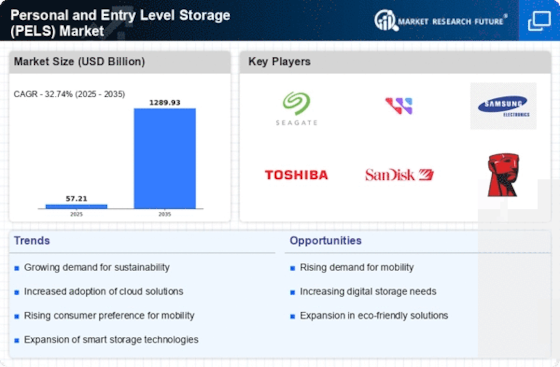

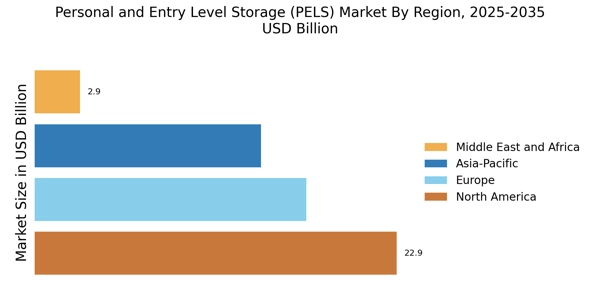

North America is the largest market for Personal and Entry Level Storage (PELS), holding approximately 40% of the global market share. The region's growth is driven by increasing data generation, the rise of remote work, and a growing demand for personal cloud storage solutions. Regulatory support for data privacy and security further catalyzes market expansion, encouraging innovation among key players. The United States dominates the PELS market, with significant contributions from Canada. Major companies like Seagate Technology, Western Digital, and SanDisk Corporation are headquartered here, fostering a competitive landscape. The presence of advanced technology infrastructure and consumer awareness about data storage options enhances market dynamics, making North America a pivotal region for PELS.

Europe : Emerging Regulatory Frameworks

Europe is the second-largest market for Personal and Entry Level Storage (PELS), accounting for around 30% of the global market share. The region's growth is propelled by stringent data protection regulations, such as the GDPR, which drive demand for secure storage solutions. Additionally, the increasing adoption of digital technologies and e-commerce is fueling the need for personal storage devices, creating a robust market environment. Leading countries in Europe include Germany, the UK, and France, where consumer electronics demand is high. The competitive landscape features key players like Samsung Electronics and Toshiba Corporation, which are investing in innovative storage solutions. The presence of a well-established retail network and growing consumer awareness about data management further enhances the market's potential, positioning Europe as a significant player in the PELS sector.

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is witnessing rapid growth in the Personal and Entry Level Storage (PELS) market, holding approximately 25% of the global market share. The region's expansion is driven by increasing smartphone penetration, rising disposable incomes, and a growing trend towards digitalization. Countries like China and India are leading this growth, supported by favorable government initiatives promoting technology adoption and innovation in storage solutions. China is the largest market in the region, followed by India and Japan. The competitive landscape is characterized by the presence of local and international players, including Kingston Technology and ADATA Technology. The increasing demand for high-capacity storage devices and advancements in technology are shaping the market dynamics, making Asia-Pacific a key region for PELS growth.

Middle East and Africa : Untapped Market Potential

The Middle East and Africa (MEA) region is emerging as a significant market for Personal and Entry Level Storage (PELS), currently holding about 5% of the global market share. The growth is driven by increasing internet penetration, a rise in mobile device usage, and a growing awareness of data storage solutions. Government initiatives aimed at enhancing digital infrastructure are also contributing to market expansion, creating opportunities for growth in this region. Leading countries in the MEA include South Africa and the UAE, where the demand for personal storage devices is on the rise. The competitive landscape features both local and international players, with companies like Transcend Information gaining traction. As the region continues to develop its digital economy, the demand for innovative storage solutions is expected to grow, positioning MEA as a future hotspot for PELS.