Increasing Vehicle Electrification

The trend towards vehicle electrification is significantly influencing the Automotive Keyless Entry Systems Market. As electric vehicles (EVs) gain traction, the demand for keyless entry systems that complement these vehicles is on the rise. Keyless entry systems are often integrated with other smart technologies in EVs, enhancing the overall driving experience. Market data suggests that the growth of the electric vehicle segment is likely to drive the adoption of keyless entry systems, as consumers seek modern features that align with their eco-friendly choices. This shift towards electrification not only supports the growth of the Automotive Keyless Entry Systems Market but also encourages manufacturers to innovate and develop systems that cater specifically to the needs of EV owners.

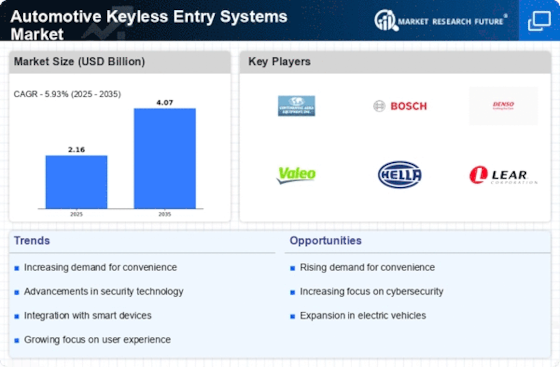

Rising Demand for Convenience Features

The Automotive Keyless Entry Systems Market is experiencing a notable surge in demand for convenience features among consumers. As vehicles become increasingly integrated with advanced technology, the preference for keyless entry systems has grown. These systems offer seamless access to vehicles, eliminating the need for traditional keys. According to recent data, the market for keyless entry systems is projected to expand significantly, driven by consumer expectations for enhanced convenience. This trend is particularly evident in urban areas, where the fast-paced lifestyle necessitates quick and easy access to vehicles. As manufacturers respond to this demand, the Automotive Keyless Entry Systems Market is likely to witness innovations that further streamline user experience, potentially leading to increased adoption rates.

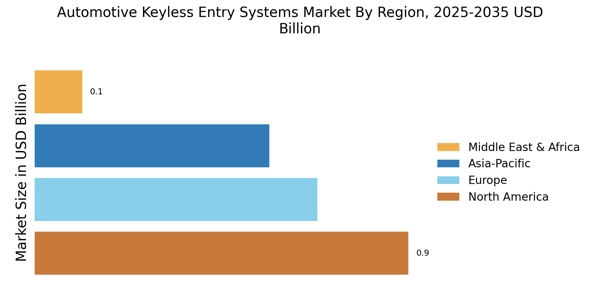

Regulatory Support for Advanced Safety Features

Regulatory support for advanced safety features is emerging as a significant driver in the Automotive Keyless Entry Systems Market. Governments are increasingly mandating the inclusion of advanced safety technologies in vehicles, which includes keyless entry systems. This regulatory push is aimed at enhancing vehicle security and reducing theft rates. Data suggests that regions with stringent safety regulations are witnessing a faster adoption of keyless entry systems, as manufacturers comply with these requirements. As a result, the Automotive Keyless Entry Systems Market is likely to benefit from this regulatory environment, encouraging further investment in research and development to meet safety standards while also appealing to safety-conscious consumers.

Consumer Preference for Enhanced User Experience

Consumer preferences are shifting towards enhanced user experiences, which is a key driver for the Automotive Keyless Entry Systems Market. As individuals seek more intuitive and user-friendly interfaces, manufacturers are focusing on developing keyless entry systems that offer seamless integration with smartphones and other devices. This trend is reflected in the increasing popularity of mobile applications that allow users to control vehicle access remotely. Market analysis indicates that systems providing a superior user experience are likely to capture a larger share of the market, as consumers prioritize convenience and functionality. Consequently, the Automotive Keyless Entry Systems Market is adapting to these preferences, fostering innovation that aligns with consumer expectations.

Technological Advancements in Automotive Security

Technological advancements play a pivotal role in shaping the Automotive Keyless Entry Systems Market. With the rise of sophisticated security threats, manufacturers are compelled to enhance the security features of keyless entry systems. Innovations such as biometric authentication and encrypted communication protocols are becoming more prevalent, addressing consumer concerns regarding vehicle theft. Data indicates that the integration of advanced security measures is expected to bolster market growth, as consumers prioritize safety alongside convenience. The Automotive Keyless Entry Systems Market is thus evolving to incorporate these technologies, which not only improve security but also enhance the overall user experience, making vehicles more appealing to potential buyers.