Regulatory Compliance

Regulatory compliance is a significant driver influencing the Personal Care Chemicals and Ingredients Market. As governments and regulatory bodies implement stricter guidelines regarding ingredient safety and product efficacy, manufacturers must adapt to these evolving standards. Compliance with regulations such as the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) is essential for market access. This necessitates investment in research and development to ensure that products meet safety and efficacy requirements. Companies that proactively address regulatory challenges are likely to gain a competitive edge, as they can assure consumers of product safety and quality. The emphasis on compliance not only protects consumers but also fosters innovation within the industry, as brands seek to develop safer and more effective formulations.

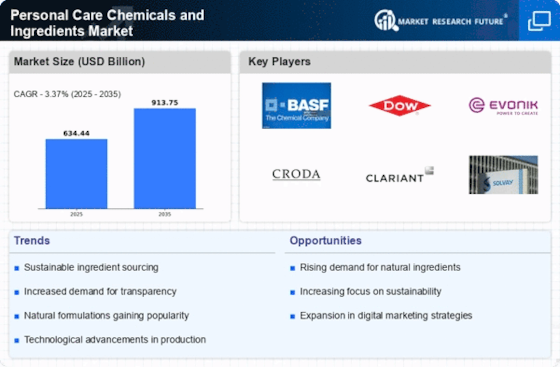

Sustainability Initiatives

Sustainability has emerged as a critical driver within the Personal Care Chemicals and Ingredients Market. As environmental concerns gain prominence, consumers are increasingly favoring brands that prioritize eco-friendly practices. This shift is prompting manufacturers to adopt sustainable sourcing of raw materials and implement greener production processes. Reports indicate that the market for sustainable personal care products is projected to grow significantly, reflecting a broader trend towards responsible consumption. Companies are investing in biodegradable packaging and reducing carbon footprints, which not only appeals to environmentally conscious consumers but also aligns with regulatory pressures for sustainability. This commitment to sustainability is likely to shape the future landscape of the personal care sector, influencing product development and marketing strategies.

Technological Advancements

Technological advancements are playing a pivotal role in shaping the Personal Care Chemicals and Ingredients Market. Innovations in formulation technologies, such as encapsulation and nanotechnology, are enabling the development of more effective and targeted personal care products. These advancements allow for enhanced delivery systems, improving the efficacy of active ingredients. Furthermore, the rise of digital technologies facilitates personalized skincare solutions, where consumers can receive tailored recommendations based on their unique skin types and concerns. Market data suggests that the integration of technology in product development is likely to drive growth, as consumers increasingly seek customized experiences. This trend not only enhances consumer satisfaction but also fosters brand loyalty, positioning companies at the forefront of the competitive landscape.

Increasing Consumer Awareness

The Personal Care Chemicals and Ingredients Market is experiencing a notable shift as consumers become increasingly aware of the ingredients in their personal care products. This heightened awareness drives demand for transparency and safety in formulations. As a result, manufacturers are compelled to disclose ingredient sourcing and potential allergens, which influences purchasing decisions. According to recent surveys, a significant percentage of consumers express a preference for products with natural and organic ingredients, leading to a surge in demand for such formulations. This trend not only enhances consumer trust but also encourages brands to innovate and reformulate their products to align with consumer expectations. Consequently, the industry is witnessing a transformation where ingredient integrity becomes a pivotal factor in market competitiveness.

Rising Demand for Anti-Aging Products

The demand for anti-aging products is significantly influencing the Personal Care Chemicals and Ingredients Market. As populations age, there is a growing interest in products that promise to reduce the visible signs of aging. This trend is particularly pronounced among millennials and Generation Z consumers, who are increasingly investing in skincare regimens that include anti-aging formulations. Market analysis indicates that the anti-aging segment is expected to witness substantial growth, driven by advancements in ingredient technology and consumer education regarding skincare. Brands are responding by incorporating innovative ingredients such as peptides and antioxidants, which are believed to enhance skin health and appearance. This rising demand not only propels market growth but also encourages continuous research into effective anti-aging solutions.