Rising Geriatric Population

The rising geriatric population is a significant driver of the Peripheral Angioplasty Market. As individuals age, they are more susceptible to cardiovascular diseases, including PAD. The World Health Organization projects that the number of people aged 60 years and older will double from 12% to 22% of the global population by 2050. This demographic shift is likely to increase the demand for angioplasty procedures as older adults seek effective treatments for their vascular conditions. Consequently, the Peripheral Angioplasty Market is expected to expand in response to the growing needs of this population, highlighting the importance of tailored healthcare solutions.

Supportive Regulatory Frameworks

Supportive regulatory frameworks are playing a crucial role in shaping the Peripheral Angioplasty Market. Regulatory bodies are increasingly approving new devices and technologies that enhance the safety and efficacy of angioplasty procedures. This regulatory support fosters innovation and encourages manufacturers to invest in research and development. As a result, the market is likely to see a surge in the introduction of advanced angioplasty solutions. Furthermore, streamlined approval processes can expedite the availability of these innovations to healthcare providers, thereby enhancing patient care and driving growth in the Peripheral Angioplasty Market.

Rising Prevalence of Peripheral Artery Disease

The increasing incidence of peripheral artery disease (PAD) is a primary driver for the Peripheral Angioplasty Market. As populations age, the prevalence of conditions such as diabetes and hypertension rises, leading to higher rates of PAD. According to recent estimates, PAD affects approximately 8 to 12 million individuals in the United States alone. This growing patient population necessitates effective treatment options, including angioplasty procedures. The Peripheral Angioplasty Market is likely to expand as healthcare providers seek to address the needs of these patients, offering innovative solutions to improve vascular health and reduce complications associated with PAD.

Technological Innovations in Angioplasty Devices

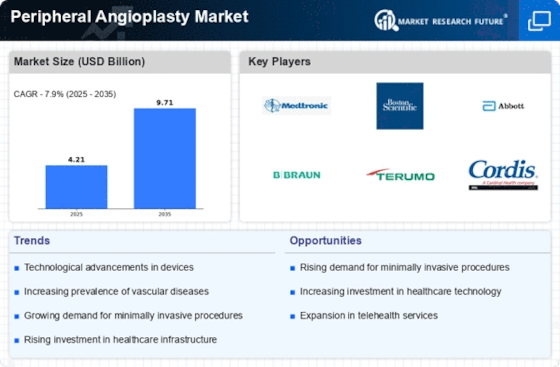

Technological advancements in angioplasty devices are significantly influencing the Peripheral Angioplasty Market. Innovations such as drug-eluting balloons and bioresorbable stents have enhanced the efficacy and safety of angioplasty procedures. These devices are designed to reduce restenosis rates and improve patient outcomes. The market for these advanced devices is projected to grow, with estimates suggesting a compound annual growth rate of over 6% in the coming years. As healthcare providers increasingly adopt these technologies, the Peripheral Angioplasty Market is expected to witness substantial growth, driven by the demand for improved treatment options.

Increasing Awareness and Education on Vascular Health

The growing awareness and education surrounding vascular health are contributing to the expansion of the Peripheral Angioplasty Market. Public health campaigns and educational initiatives aimed at promoting awareness of PAD and its risk factors are encouraging individuals to seek medical attention sooner. This proactive approach leads to earlier diagnosis and treatment, including angioplasty procedures. As more patients become informed about their vascular health, the demand for effective interventions is likely to rise, thereby propelling the Peripheral Angioplasty Market forward. Healthcare providers are responding by enhancing their services to meet this increasing demand.