Aging Population

The aging population worldwide is a significant factor contributing to the Global Periodontal Therapeutics Market Industry. As individuals age, they become more susceptible to periodontal diseases due to factors such as reduced immunity and chronic health conditions. The World Health Organization indicates that the global population aged 60 years and older is projected to reach 2.1 billion by 2050. This demographic shift necessitates increased therapeutic interventions to manage periodontal health effectively. Consequently, the demand for periodontal therapeutics is expected to rise, further propelling the market's growth trajectory in the coming years.

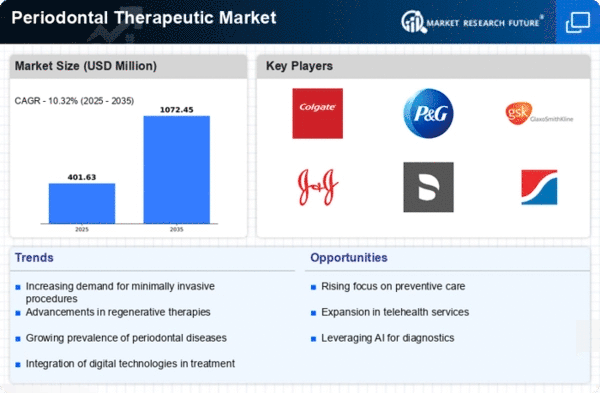

Market Growth Projections

The Global Periodontal Therapeutics Market is poised for substantial growth, with projections indicating a rise from 3.27 USD Billion in 2024 to 5 USD Billion by 2035. This growth trajectory reflects a compound annual growth rate of 3.94% from 2025 to 2035, driven by various factors such as increasing prevalence of periodontal diseases, advancements in therapeutic technologies, and heightened awareness of oral health. The market's expansion is indicative of the growing recognition of periodontal health's importance in overall health, leading to increased investments in research and development within the industry.

Increased Awareness and Education

Growing awareness regarding oral health and periodontal diseases is a crucial driver for the Global Periodontal Therapeutics Market Industry. Educational initiatives by dental associations and healthcare providers emphasize the importance of regular dental check-ups and proper oral hygiene practices. This heightened awareness leads to early diagnosis and treatment of periodontal conditions, ultimately fostering market growth. As patients become more informed about the consequences of untreated periodontal diseases, the demand for therapeutic interventions rises. Consequently, the Global Periodontal Therapeutics Market is anticipated to witness a compound annual growth rate of 3.94% from 2025 to 2035.

Advancements in Therapeutic Technologies

Technological advancements in periodontal therapeutics are significantly influencing the Global Periodontal Therapeutics Market Industry. Innovations such as laser therapy, regenerative techniques, and the development of bioactive materials enhance treatment efficacy and patient outcomes. For instance, laser-assisted periodontal therapy has shown promising results in reducing pocket depth and promoting tissue regeneration. These advancements not only improve treatment success rates but also attract more patients seeking effective solutions. As the market evolves, the integration of cutting-edge technologies is expected to propel the Global Periodontal Therapeutics Market towards an estimated value of 5 USD Billion by 2035.

Rising Prevalence of Periodontal Diseases

The increasing incidence of periodontal diseases globally drives the Global Periodontal Therapeutics Market Industry. According to health statistics, approximately 47.2% of adults aged 30 years and older exhibit some form of periodontal disease. This alarming prevalence necessitates effective therapeutic interventions, contributing to the market's growth. As awareness of oral health continues to rise, patients are more inclined to seek treatment, thereby expanding the market. The Global Periodontal Therapeutics Market is projected to reach 3.27 USD Billion in 2024, reflecting the urgent need for innovative therapeutic solutions to combat periodontal diseases.

Regulatory Support and Reimbursement Policies

Supportive regulatory frameworks and favorable reimbursement policies are vital drivers for the Global Periodontal Therapeutics Market Industry. Governments and health organizations are increasingly recognizing the importance of oral health in overall well-being, leading to the establishment of policies that promote access to periodontal treatments. Enhanced reimbursement options for periodontal therapies encourage patients to seek necessary care, thereby boosting market growth. As these supportive measures continue to evolve, the Global Periodontal Therapeutics Market is likely to experience sustained expansion, aligning with the projected growth trends.